Question: Enter as formula 1. Analyze a mixed cost using the high-low method. 2. Prepare an income statement for a merchandising company using the contribution format.

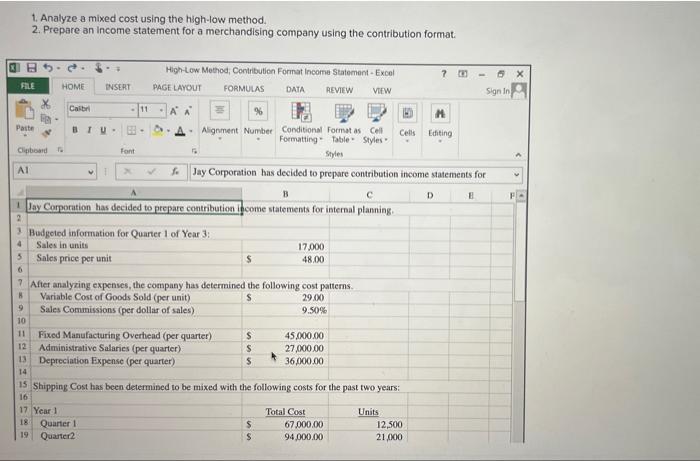

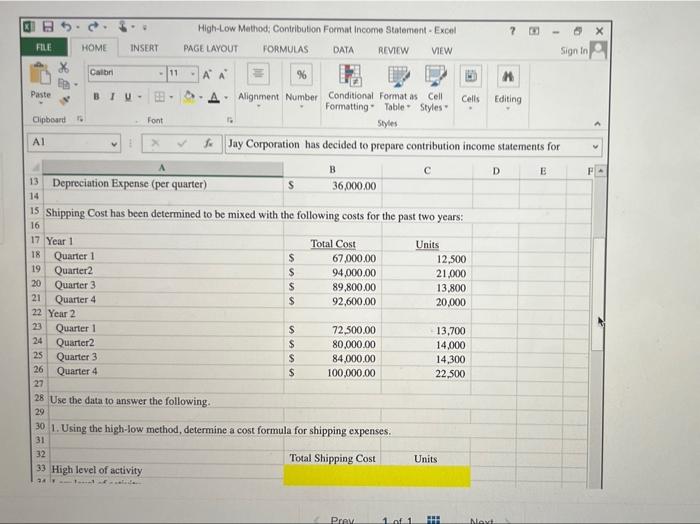

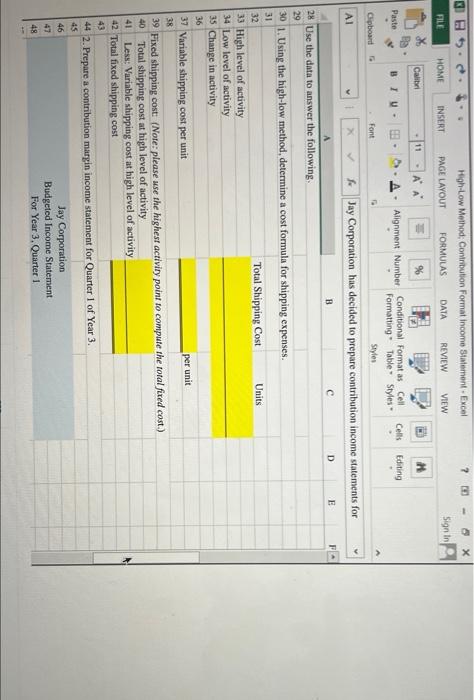

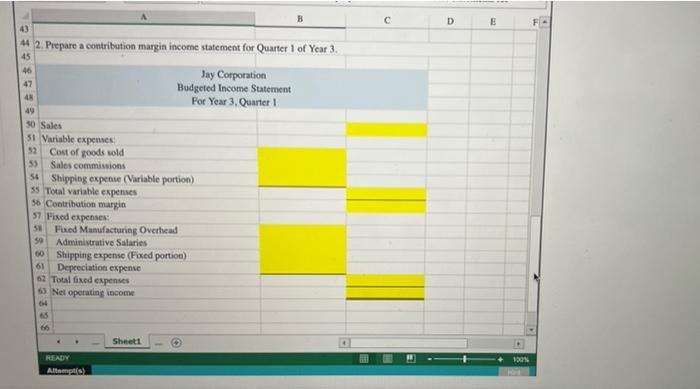

1. Analyze a mixed cost using the high-low method. 2. Prepare an income statement for a merchandising company using the contribution format. 08 - Excel ? 00 High-Low Method; Contribution Format Income Statement-E PAGE LAYOUT FORMULAS DATA REVIEW VIEW FILE HOME INSERT 11 A % M Paste A Alignment Number Editing Conditional Format as Cell Cells Formatting Table Styles Styles Clipboard Font G Al 1 f. Jay Corporation has decided to prepare contribution income statements for B D B 1 Jay Corporation has decided to prepare contribution income statements for internal planning. 2 3 Budgeted information for Quarter 1 of Year 3:1 4 Sales in units 17,000 48.00 5 Sales price per unit $ 6 7 After analyzing expenses, the company has determined the following cost patterns. K Variable Cost of Goods Sold (per unit) S 29.00 9 Sales Commissions (per dollar of sales) 9.50% 10 11 Fixed Manufacturing Overhead (per quarter) 45,000.00 12 Administrative Salaries (per quarter) $ 27,000,00 13 Depreciation Expense (per quarter) $ 36,000.00 14 15 Shipping Cost has been determined to be mixed with the following costs for the past two years: 16 17 Year 1 Total Cost Units 18 Quarter 1 $ 12,500 67,000.00 94,000.00 19 Quarter2 $ 21,000 Calibri BIU- $ - 5 X Sign In D ? High-Low Method; Contribution Format Income Statement-Excel PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calbri -11 -AA BIU- A- Alignment Number Conditional Format as Cell Cells Formatting Table Styles Editing G Styles 1 f Jay Corporation has decided to prepare contribution income statements for A B C D E Depreciation Expense (per quarter) S 36,000.00 14 15 Shipping Cost has been determined to be mixed with the following costs for the past two years: 16 17 Year 1 Total Cost Units 18 Quarter 1 $ 12,500 67,000.00 94,000.00 21,000 19 Quarter2 Quarter 3 Quarter 4 20 89,800.00 13,800 92,600.00 20,000 22 Year 2 72,500.00 13,700 24 80,000.00 14,000 Quarter 1 Quarter2 Quarter 3 26 Quarter 4 84,000.00 14,300 $ 100,000.00 22,500 28 Use the data to answer the following. 29 30 1. Using the high-low method, determine a cost formula for shipping expenses. 31 Total Shipping Cost 33 High level of activity 24te Prev FILE Paste Clipboard Al SASKA22 13 7227325388 SR 21 32 HOME INSERT 68- Font SSSS $ $ $ $ SSSS Units 1 of 1 P 5 Navt A D Sign In X 4 High-Low Method; Contribution Format Income Statement-Excel ? FILE PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri -AA % Paste BIU- - A. Alignment Number Conditional Format as Cell Formatting Table Styles Cells Editing Clipboard Styles AI & Jay Corporation has decided to prepare contribution income statements for A B C D E 28 Use the data to answer the following. 29 30 1. Using the high-low method, determine a cost formula for shipping expenses. 31 32 Total Shipping Cost Units 33 High level of activity 34 Low level of activity 35 Change in activity 36 37 Variable shipping cost per unit per unit 38 39 Fixed shipping cost: (Note: please use the highest activity point to compute the total fixed cost.) 40 Total shipping cost at high level of activity 41 Less: Variable shipping cost at high level of activity 42 Total fixed shipping cost 43 44 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. Jay Corporation Budgeted Income Statement For Year 3, Quarter 1 43457! 46 48 X B- HOME INSERT 11 E- Font X B 43 44 2. Prepare a contribution margin income statement for Quarter 1 of Year 3. 45 46 Jay Corporation Budgeted Income Statement For Year 3, Quarter 1 49 30 Sales 51 Variable expenses 52 Cost of goods sold 53 Sales commissions 54 Shipping expense (Variable portion) 55 Total variable expenses 56 Contribution margin 57 Fixed expenses 58 Fixed Manufacturing Overhead 59 Administrative Salaries 60 Shipping expense (Fixed portion) 61 Depreciation expense 62 Total fixed expenses 63 Net operating income 64 Sheet1 47 48 65 66 READY Attempt(s) 3 C D B 100% PH

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts