Question: Enter each financial transaction into a general journal. - show whats needs to be debited and credited Job Cost Information 1. Payroll disbursement was made

Enter each financial transaction into a general journal. - show whats needs to be debited and credited

Enter each financial transaction into a general journal. - show whats needs to be debited and credited

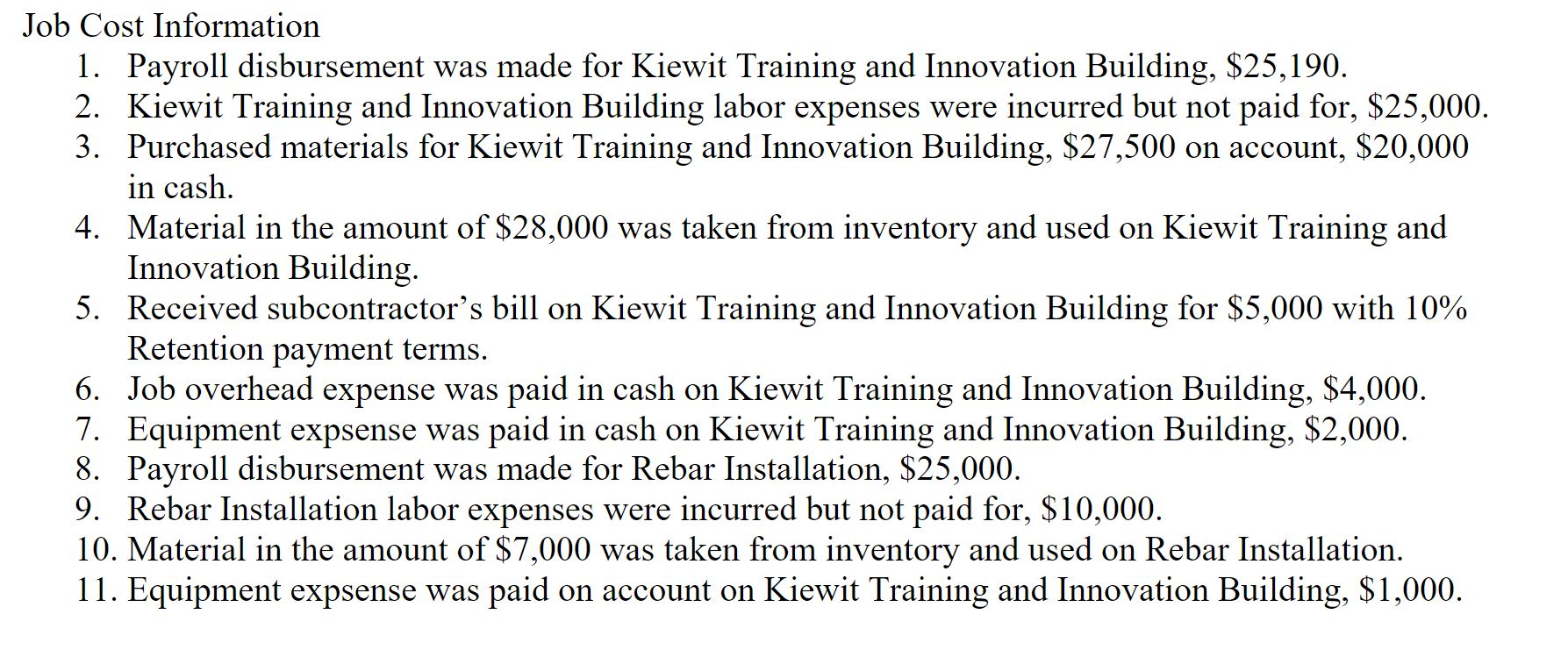

Job Cost Information 1. Payroll disbursement was made for Kiewit Training and Innovation Building, $25,190. 2. Kiewit Training and Innovation Building labor expenses were incurred but not paid for, $25,000. 3. Purchased materials for Kiewit Training and Innovation Building, $27,500 on account, $20,000 in cash. 4. Material in the amount of $28,000 was taken from inventory and used on Kiewit Training and Innovation Building. 5. Received subcontractor's bill on Kiewit Training and Innovation Building for $5,000 with 10% Retention payment terms. 6. Job overhead expense was paid in cash on Kiewit Training and Innovation Building, $4,000. 7. Equipment expsense was paid in cash on Kiewit Training and Innovation Building, $2,000. 8. Payroll disbursement was made for Rebar Installation, $25,000. 9. Rebar Installation labor expenses were incurred but not paid for, $10,000. 10. Material in the amount of $7,000 was taken from inventory and used on Rebar Installation. 11. Equipment expsense was paid on account on Kiewit Training and Innovation Building, $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts