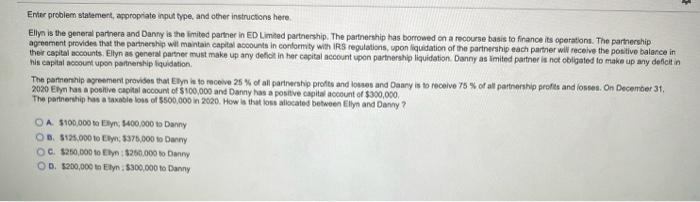

Question: Enter problem statement, appropriate input type, and other instructions here Ellyn is the general partners and Danny is the limited partner in ED Limited partnership.

Enter problem statement, appropriate input type, and other instructions here Ellyn is the general partners and Danny is the limited partner in ED Limited partnership. The partnership has borrowed on a recourse basis to finance its operations. The partnership agreement provides that the partnership wit maintain capital account in conformity with regulations, upon liquidation of the partnership each partner will receive the positive balance in ther capital socounts. Ellyn as general partner must make up any detot in her capital account upon partnership liquidation. Danny as imited partner is not obligated to make up any deficit in his capital count upon partsship liquidation The pannenship agreement provides that Ebyn in to receive 25% of all partnership profits and losses and Deary is to receive 78% of all partnership profts and ones. On December 31, 2020 Elyn has a positive capital account of $100.000 and Danny has a positive capital account of $300,000 The partnership has a taxable low of $500,000 in 2020. How is that for allocated between Ellyn and Danny? O A $100,000 to Ellyn, 6400,000 to Danny OB. 5125.000 to Elyn: 5375,000 to Danny OG $250,000 to Ely: $260.000 to Dan OD. $200,000 in Elyn. $300,000 to Danny

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts