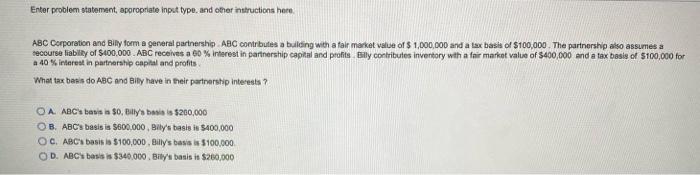

Question: Enter problem statement appropriate input type and other instructions here. ABC Corporation and Bily form a general partnership ABC contrutes a building with a for

Enter problem statement appropriate input type and other instructions here. ABC Corporation and Bily form a general partnership ABC contrutes a building with a for market value of $ 1,000,000 and a tax basis of $100,000 The partnership also assumes a tecourse liability of $400.000ABC receives a 60% Interest in partnership capital and profits Billy contributes inventory with a fair market value of $400,000 and a tax basis of $100,000 for a 40% interest in partnership capital and profits What tax basis do ABC and Billy have in their partnership interests? OA ABC's avis is $0, Billy's basis is $200,000 OB. ABC's basis is $600,000. Bily's basis is $400,000 OG ABC's basis is $100,000. Billy's bass is 100,000 OD. ABC bass is $340,000. Billy's basis is $200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts