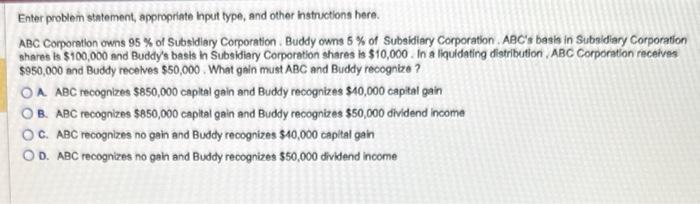

Question: Enter problem statement, appropriate Input type, and other instructions here. ABC Corporation owns 95 % of Subsidiary Corporation. Buddy owns 5 % of Subsidiary

Enter problem statement, appropriate Input type, and other instructions here. ABC Corporation owns 95 % of Subsidiary Corporation. Buddy owns 5 % of Subsidiary Corporation. ABC's basis in Subsidiary Corporation shares is $100,000 and Buddy's basis in Subsidiary Corporation shares is $10,000. In a liquidating distribution, ABC Corporation receives $950,000 and Buddy receives $50,000. What gain must ABC and Buddy recognize? OA ABC recognizes $850,000 capital gain and Buddy recognizes $40,000 capital gain OB. ABC recognizes $850,000 capital gain and Buddy recognizes $50,000 dividend income OC. ABC recognizes no gain and Buddy recognizes $40,000 capital gain OD. ABC recognizes no gain and Buddy recognizes $50,000 dividend income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts