Question: Enter the amounts in the table below. Enter gains as positive values and losses as positive values. If the amount is zero, enter a zero

Enter the amounts in the table below. Enter gains as positive values and losses as positive values. If the amount is zero, enter a zero (0).

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Gain (Loss) Recognized | Post-Distribution Stock Basis | Basis in Property Distributed | |

| 2 | JKL Corp. | |||

| 3 | Janet | |||

| 4 | Karen | |||

| 5 | Lisa |

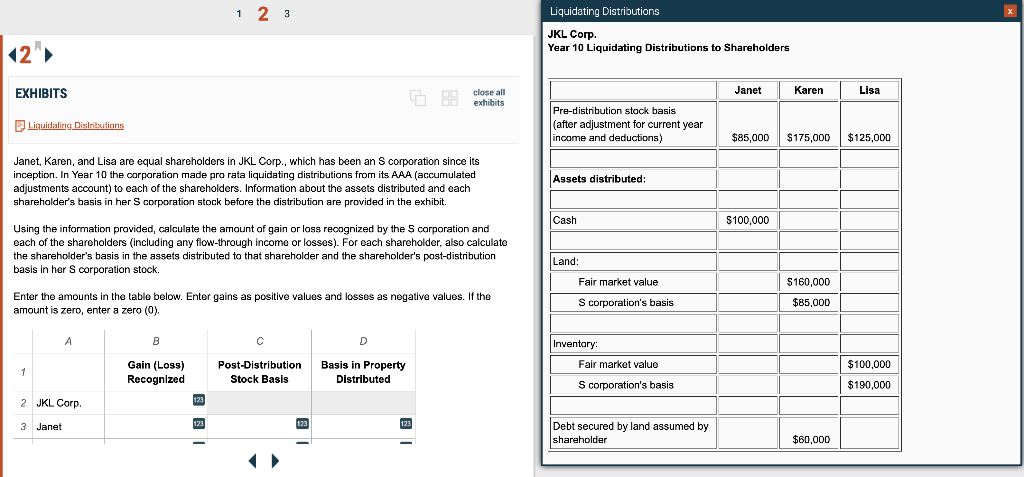

1 2 3 Liquidating Distributions JKL Corp. Year 10 Liquidating Distributions to Shareholders 12 EXHIBITS Janet Karen close all exhibits Lisa Liquidaling Distributions Pre-distribution stock basis (after adjustment for current year income and deductions) $85,000 $175,000 $125,000 Janet, Karen, and Lisa are equal shareholders in JKL Corp., which has been an S corporation since its inception. In Year 10 the corporation made pro rata liquidating distributions from its AAA (accumulated adjustments account) to each of the shareholders. Information about the assets distributed and each shareholder's basis in her corporation stock before the distribution are provided in the exhibit. Assets distributed: : Cash $100,000 Using the information provided, calculate the amount of gain or loss recognized by the corporation and each of the shareholders (including any flow-through income or losses). For each shareholder, also calculate the shareholder's basis in the assets distributed to that shareholder and the shareholder's post-distribution basis in her S corporation stock. Land: : Fair market value $160,000 Enter the amounts in the table below. Enter gains as positive values and losses as negative values. If the amount is zero, enter a zero (O). , a 0 S corporation's basis $85,000 A B B D Inventary: Fair market value $100,000 1 Gain (Loss) Recognized Post-Distribution Stock Basis Basis in Property Distributed S corporation's basis $190,000 2 JKL Corp. 123 3 Janet 123 123 123 Debt secured by land assumed by shareholder $60,000 1 2 3 Liquidating Distributions JKL Corp. Year 10 Liquidating Distributions to Shareholders 12 EXHIBITS Janet Karen close all exhibits Lisa Liquidaling Distributions Pre-distribution stock basis (after adjustment for current year income and deductions) $85,000 $175,000 $125,000 Janet, Karen, and Lisa are equal shareholders in JKL Corp., which has been an S corporation since its inception. In Year 10 the corporation made pro rata liquidating distributions from its AAA (accumulated adjustments account) to each of the shareholders. Information about the assets distributed and each shareholder's basis in her corporation stock before the distribution are provided in the exhibit. Assets distributed: : Cash $100,000 Using the information provided, calculate the amount of gain or loss recognized by the corporation and each of the shareholders (including any flow-through income or losses). For each shareholder, also calculate the shareholder's basis in the assets distributed to that shareholder and the shareholder's post-distribution basis in her S corporation stock. Land: : Fair market value $160,000 Enter the amounts in the table below. Enter gains as positive values and losses as negative values. If the amount is zero, enter a zero (O). , a 0 S corporation's basis $85,000 A B B D Inventary: Fair market value $100,000 1 Gain (Loss) Recognized Post-Distribution Stock Basis Basis in Property Distributed S corporation's basis $190,000 2 JKL Corp. 123 3 Janet 123 123 123 Debt secured by land assumed by shareholder $60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts