Question: EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The production manager believes that the source of the

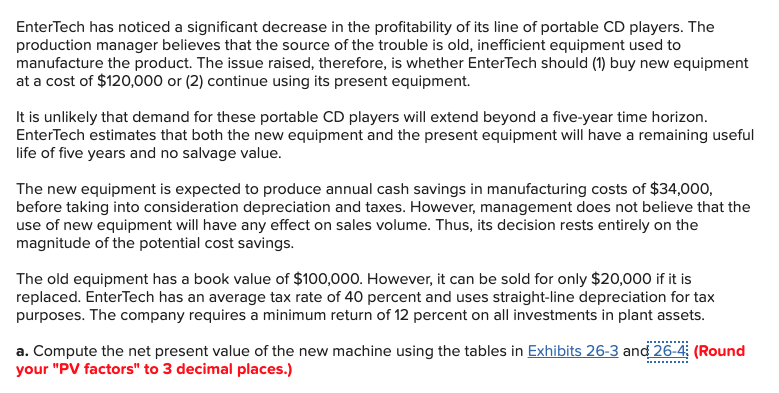

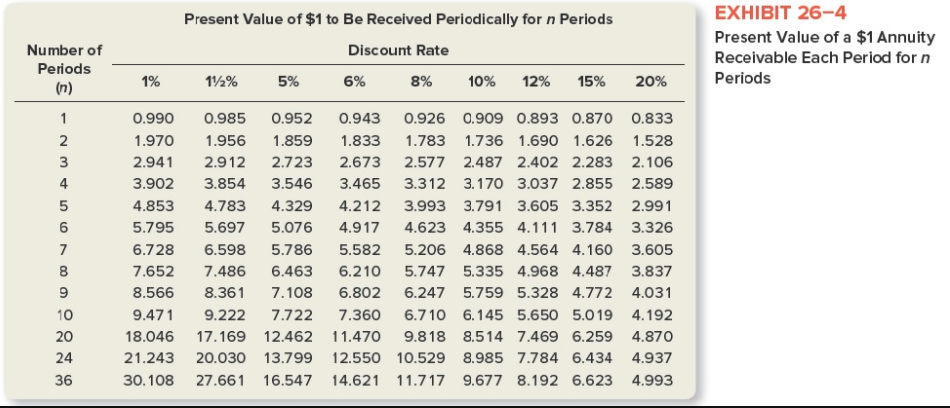

EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The production manager believes that the source of the trouble is old, inefficient equipment used to manufacture the product. The issue raised, therefore, is whether EnterTech should (1) buy new equipment at a cost of $120,000 or (2) continue using its present equipment. It is unlikely that demand for these portable CD players will extend beyond a five-year time horizon. EnterTech estimates that both the new equipment and the present equipment will have a remaining useful life of five years and no salvage value. The new equipment is expected to produce annual cash savings in manufacturing costs of $34,000, before taking into consideration depreciation and taxes. However, management does not believe that the use of new equipment will have any effect on sales volume. Thus, its decision rests entirely on the magnitude of the potential cost savings. The old equipment has a book value of $100,000. However, it can be sold for only $20,000 if it is replaced. EnterTech has an average tax rate of 40 percent and uses straight-line depreciation for tax purposes. The company requires a minimum return of 12 percent on all investments in plant assets. a. Compute the net present value of the new machine using the tables in Exhibits 26-3 and 26-4; (Round your "PV factors" to 3 decimal places.) Present Value of $1 to Be Received Periodically for n Periods Discount Rate Number of Periods EXHIBIT 26-4 Present Value of a $1 Annuity Receivable Each Period forn Periods 1% 11/2% 5% 6% 8% 10% 12% 15% 20% 0.990 0.985 0.952 0.943 0.926 0.909 0.893 0.870 0.833 1.970 1.956 1.8591.833 1.783 1.736 1.690 1.626 1.528 2.9412.912 2.723 2.673 2.577 2.487 2.402 2.283 2.106 3.902 3.854 3.546 3.465 3.312 3.170 3.037 2.855 2.589 4.853 4.783 4.329 4.212 3.993 3.791 3.605 3.352 2.991 5.795 5.697 5.0764.917 4.623 4.355 4.111 3.784 3.326 6.728 6.598 5.786 5.5825.206 4.868 4.564 4.160 3.605 7.652 7.486 6.463 6.210 5.747 5.335 4.968 4.487 3.837 8.566 8.3617.108 6.802 6.247 5.759 5.328 4.772 4.031 9.471 9.222 7.722 7.360 6.710 6.145 5.650 5.0 19 4.192 18.046 17.169 12.462 11.470 9.818 8.514 7.469 6.259 4.870 21.243 20.030 13.799 12.550 10.529 8.985 7.784 6.434 4.937 30.108 27.661 16.547 14.621 11.717 9.677 8.192 6.623 4.993 Present Value of $1 Due in n Periods Discount Rate Number of Periods EXHIBIT 26-3 Present Value of $1 Payable in n Periods 10% 909 826 .751 .683 20% 833 694 579 482 .621 .402 1% 172% .990 985 .980 .971 .971 956 .961 942 .951 .928 .942 915 .933 901 .923 888 .914 .875 .905 .862 .820 742 .788700 .699 585 5% 952 907 .864 .823 .784 746 711 .677 .645 .614 377 310 .173 6% 943 890 .840 .792 .747 705 .665 627 592 .558 312 247 .123 8% 926 .857 .794 .735 .681 .630 583 540 .500 .463 215 158 .063 564 513 467 424 .386 .149 . 102 .032 12% 893 797 .712 .636 .567 507 452 404 361 .322 .104 .066 .017 15% .870 .756 .658 572 .497 .432 .376 327 284 .247 .061 .035 .007 335 279 233 .194 .162 .026 .013 .001 20 24 36 The present value of $1 is computed by the formula p= 1/(1+i)n, where p is the present value of $1, is the discount rate, and n is the number of periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Many calculators are programmed to use this formula and can compute present values when the future amount is entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts