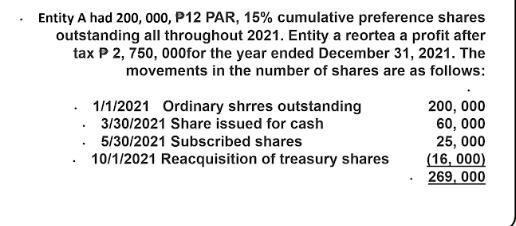

Question: Entity A had 200, 000, P12 PAR, 15% cumulative preference shares outstanding all throughout 2021. Entity a reortea a profit after tax P 2,

Entity A had 200, 000, P12 PAR, 15% cumulative preference shares outstanding all throughout 2021. Entity a reortea a profit after tax P 2, 750, 000for the year ended December 31, 2021. The movements in the number of shares are as follows: 1/1/2021 Ordinary shrres outstanding 3/30/2021 Share issued for cash 5/30/2021 Subscribed shares 10/1/2021 Reacquisition of treasury shares . 200, 000 60, 000 25,000 (16, 000) 269, 000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

To compute the basic earnings per share EPS we need to determine the weighted average number of sh... View full answer

Get step-by-step solutions from verified subject matter experts