Question: Entity B lent a customer $10,000 on a one year note, at 6% interest, with interest and principal due at maturity. The customer dishonored the

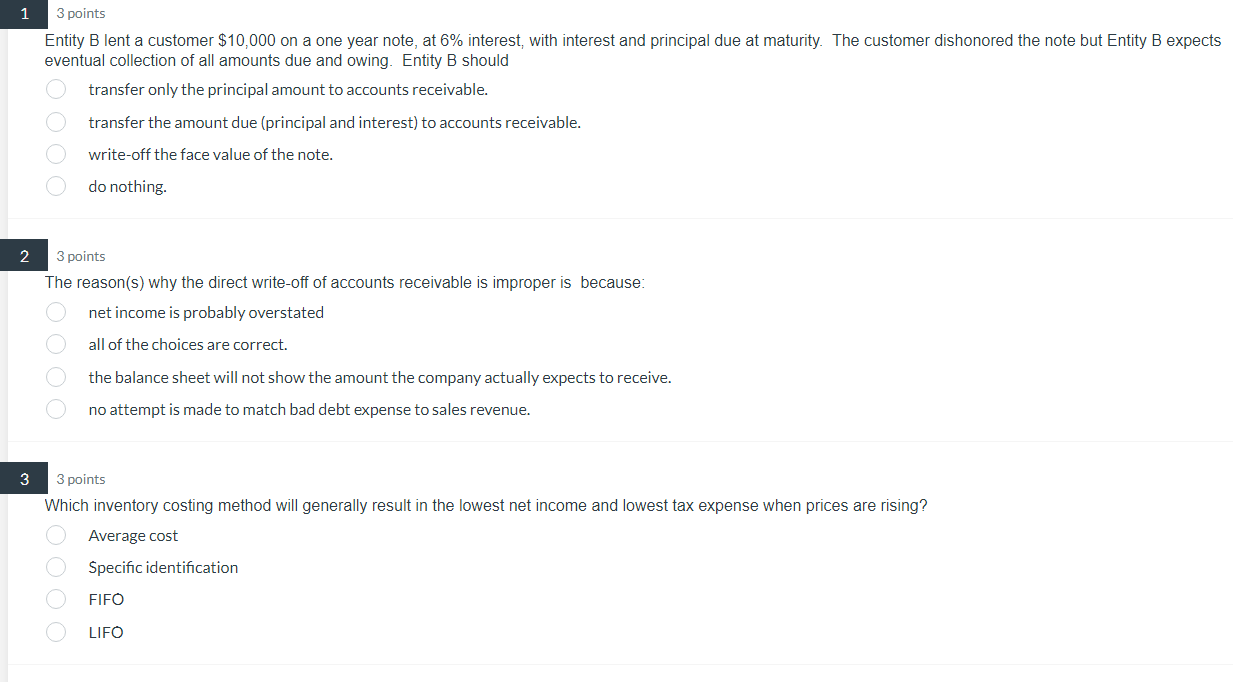

Entity B lent a customer $10,000 on a one year note, at 6% interest, with interest and principal due at maturity. The customer dishonored the note but Entity B expects eventual collection of all amounts due and owing. Entity B should transfer only the principal amount to accounts receivable. transfer the amount due (principal and interest) to accounts receivable. write-off the face value of the note. do nothing. 3 points The reason(s) why the direct write-off of accounts receivable is improper is because: net income is probably overstated all of the choices are correct. the balance sheet will not show the amount the company actually expects to receive. no attempt is made to match bad debt expense to sales revenue. 3 points Which inventory costing method will generally result in the lowest net income and lowest tax expense when prices are rising? Average cost Specific identification FIFO LIFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts