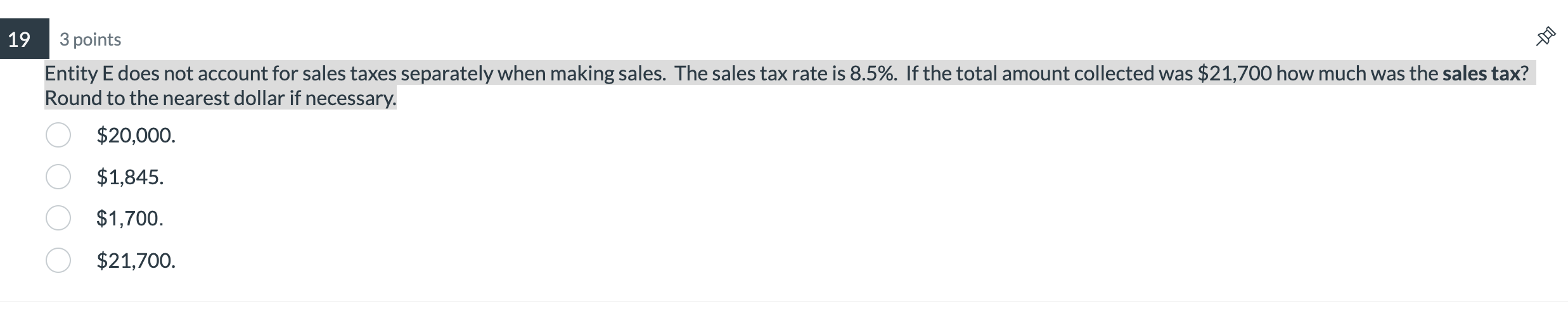

Question: Entity E does not account for sales taxes separately when making sales. The sales tax rate is 8.5%. If the total amount collected was $21,700

Entity E does not account for sales taxes separately when making sales. The sales tax rate is 8.5%. If the total amount collected was $21,700 how much was the sales tax? Round to the nearest dollar if necessary. $20,000.$1,845.$1,700.$21,700. Entity E does not account for sales taxes separately when making sales. The sales tax rate is 8.5%. If the total amount collected was $21,700 how much was the sales tax? Round to the nearest dollar if necessary. $20,000.$1,845.$1,700.$21,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts