Question: Entity T is a first-time adopter with a date of transition to IFRSs of 1 January 2X21. A new IFRS not including any amendment to

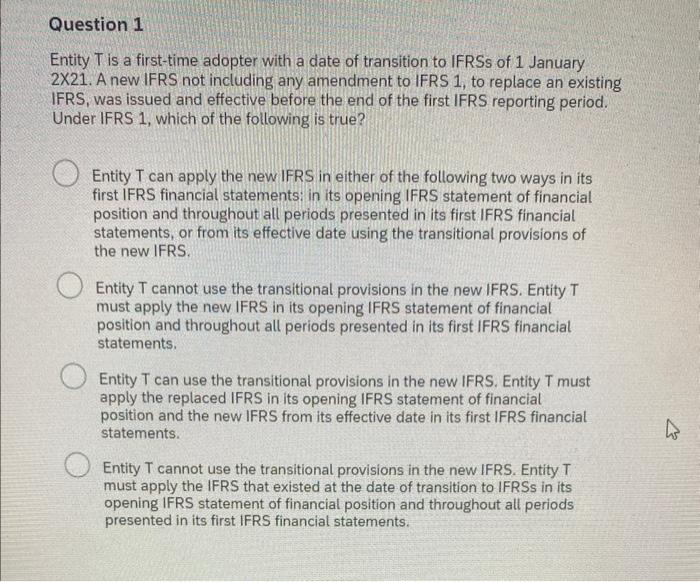

Entity T is a first-time adopter with a date of transition to IFRSs of 1 January 2X21. A new IFRS not including any amendment to IFRS 1 , to replace an existing IFRS, was issued and effective before the end of the first IFRS reporting period. Under IFRS 1, which of the following is true? Entity T can apply the new IFRS in either of the following two ways in its first IFRS financial statements: in its opening IFRS statement of financial position and throughout all periods presented in its first IFRS financial statements, or from its effective date using the transitional provisions of the new IFRS. Entity T cannot use the transitional provisions in the new IFRS. Entity T must apply the new IFRS in its opening IFRS statement of financial position and throughout all periods presented in its first IFRS financial statements. Entity T can use the transitional provisions in the new IFRS. Entity T must apply the replaced IFRS in its opening IFRS statement of financial position and the new IFRS from its effective date in its first IFRS financial statements. Entity T cannot use the transitional provisions in the new IFRS. Entity T must apply the IFRS that existed at the date of transition to IFRSs in its opening IFRS statement of financial position and throughout all periods presented in its first IFRS financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts