Question: entory and Prepaids (10 points) Saved Help Save & Exit Submit k my work mode: This shows what is correct or incorrect for the work

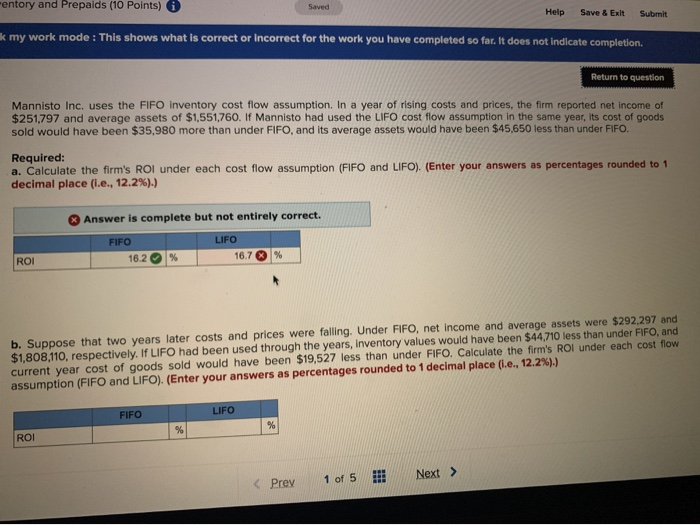

entory and Prepaids (10 points) Saved Help Save & Exit Submit k my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Mannisto Inc, uses the FIFO inventory cost flow assumption. In a year of rising costs and prices, the firm reported net income of $251.797 and average assets of $1,551,760. If Mannisto had used the LIFO cost flow assumption in the same year, its cost of goods sold would have been $35,980 more than under FIFO, and its average assets would have been $45,650 less than under FIFO. Required: a. Calculate the firm's ROI under each cost flow assumption (FIFO and LIFO). (Enter your answers as percentages rounded to 1 decimal place (i.e., 12.2%).) Answer is complete but not entirely correct. FIFO LIFO 16.2 % 16.7 % ROI b. Suppose that two years later costs and prices were falling. Under FIFO, net income and average assets were $292.297 and $1.808.110, respectively. If LIFO had been used through the years, Inventory values would have been $44,710 less than under FIFO, and current year cost of goods sold would have been $19,527 less than under FIFO. Calculate the firm's ROI under each cost flow assumption (FIFO and LIFO). (Enter your answers as percentages rounded to 1 decimal place (I.e., 12.2%).) LIFO FIFO ROI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts