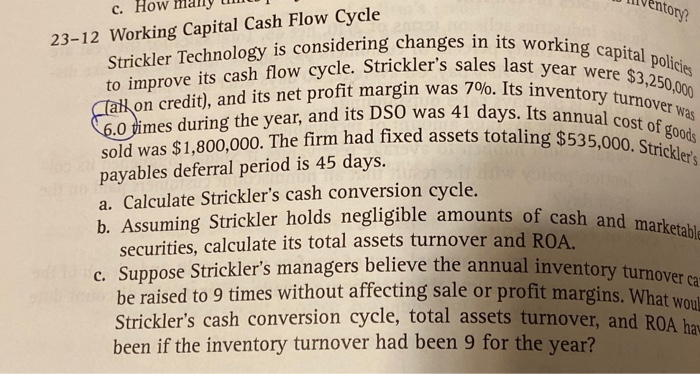

Question: entory? C. How Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Strickler's sales last year were $3,250,000

entory? C. How Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Strickler's sales last year were $3,250,000 CTaik on credit), and its net profit margin was 7%. Its inventory turnover was 6.0 times during the year, and its DSO was 41 days. Its annual cost of goods sold was $1,800,000. The firm had fixed assets totaling $535,000. Strickler's 23-12 Working Capital Cash Flow Cycle payables deferral period is 45 days. a. Calculate Strickler's cash conversion cycle. b. Assuming Strickler holds negligible amounts of cash and marketableE securities, calculate its total assets turnover and ROA. c. Suppose Strickler's managers believe the annual inventory turnover ca be raised to 9 times without affecting sale or profit margins. What woulk Strickler's cash conversion cycle, total assets turnover, and ROA ha been if the inventory turnover had been 9 for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts