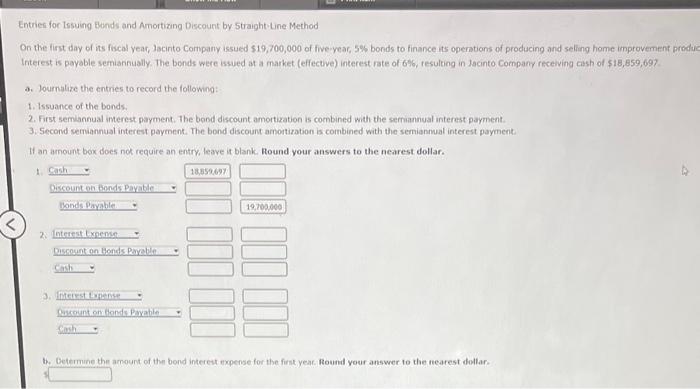

Question: Entrien for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Jacinto Company issued 519,700,000 of five year,

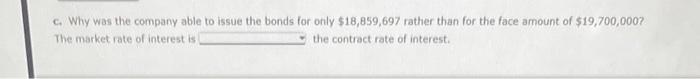

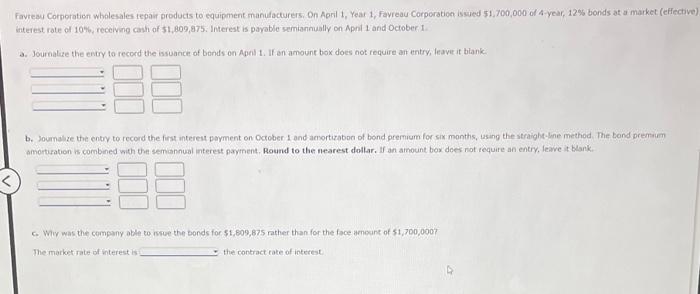

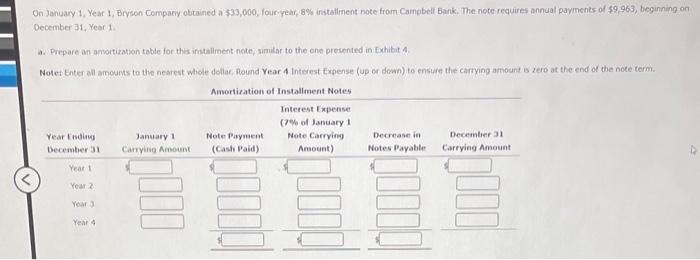

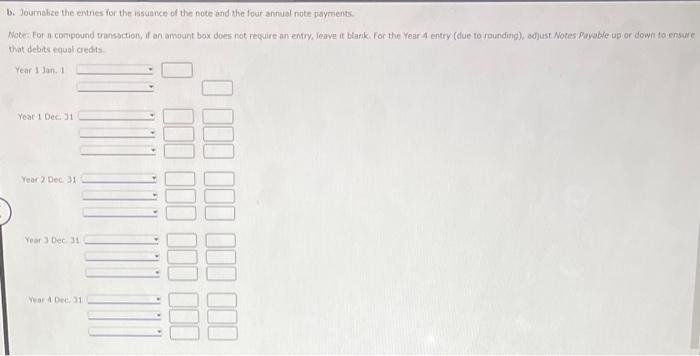

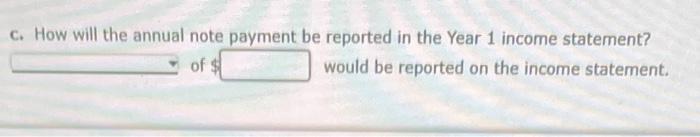

Entrien for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Jacinto Company issued 519,700,000 of five year, 5% bonds to finance its opentions of producing and selling home inprovement produ Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 676 , resulting in Jacinto Company receiving cash of 518,859,697. a. lournalize the entries to record the following: 1. Issuance of the bonds. 2. First semannual imterest payment. The bond discount amortization is combined with the sernannual interest payment. 3. Second semannual interest payment. The bond discount amontization is combined with the semiannual interest payment: If an amount box does nok require an entry, leave it blank. Round your answers to the nearest dollar. th. Determune the amount of then bond interest expense for the first yeac. Round your answer to the rearest dollar. c. Why was the company able to issue the bonds for only $18,859,697 rather than for the face amount of $19,700,000 ? The market rate of interest is the contract rate of interest. Favreau Corporation wholesales tepair products to equipment manufacturers. On April 1, Year 1 , favreau Corporation is ued 51,700,000 of 4 year, 12% bonds at a market (effective. interest rate of 10%6, receivene cash of 51,809,875. Interest is payable semiannually on Apnil 1 and October, 1. a. Journalize the entry to record the issuance of bends on Apnl 1 . If an amount box does not require an entry, leave it blank: b. Joumalie the entry to record the firs interest payment on Ootober 1 and amortizabon of bond premium for six. manths, using the atraight-line method. The band premium. amortuation is combined with the semannual interest payment, Round to the nearest dollar. If an amount box does not require an entry, leave it blank, c. Wiv was the company abie to wsee the bonds for $1,809,875 rather than for the face amcant of $1,700,000 ? The market rate of interest is the contract rate of interest. On January 1, Year 1, Bryson Compariy obtained a $33,000, fouryear, 8% installment note from Campbell Bank. The note- requires annual payments of 59 , 963 , beginning on December 31, Year 1 a. Prepare an arvortization table for this instailment note; simular to the one presented in Exhibit 4 . Notet Enter all amounts to the nearest whole dollar, Round Year 4 Interest Expense (up or dewn) to ensure the camping arnount is 2 ero at the end of the note term. b. Joumalice the entries for the issuance of the note and the four annual note payments. Note: For a compound transaction, if an amount box does not require an entry, leave it blank. For the Year 4 entry (due to rounding), adjust Notes Payable up of down to ensune c. How will the annual note payment be reported in the Year 1 income statement? of $ would be reported on the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts