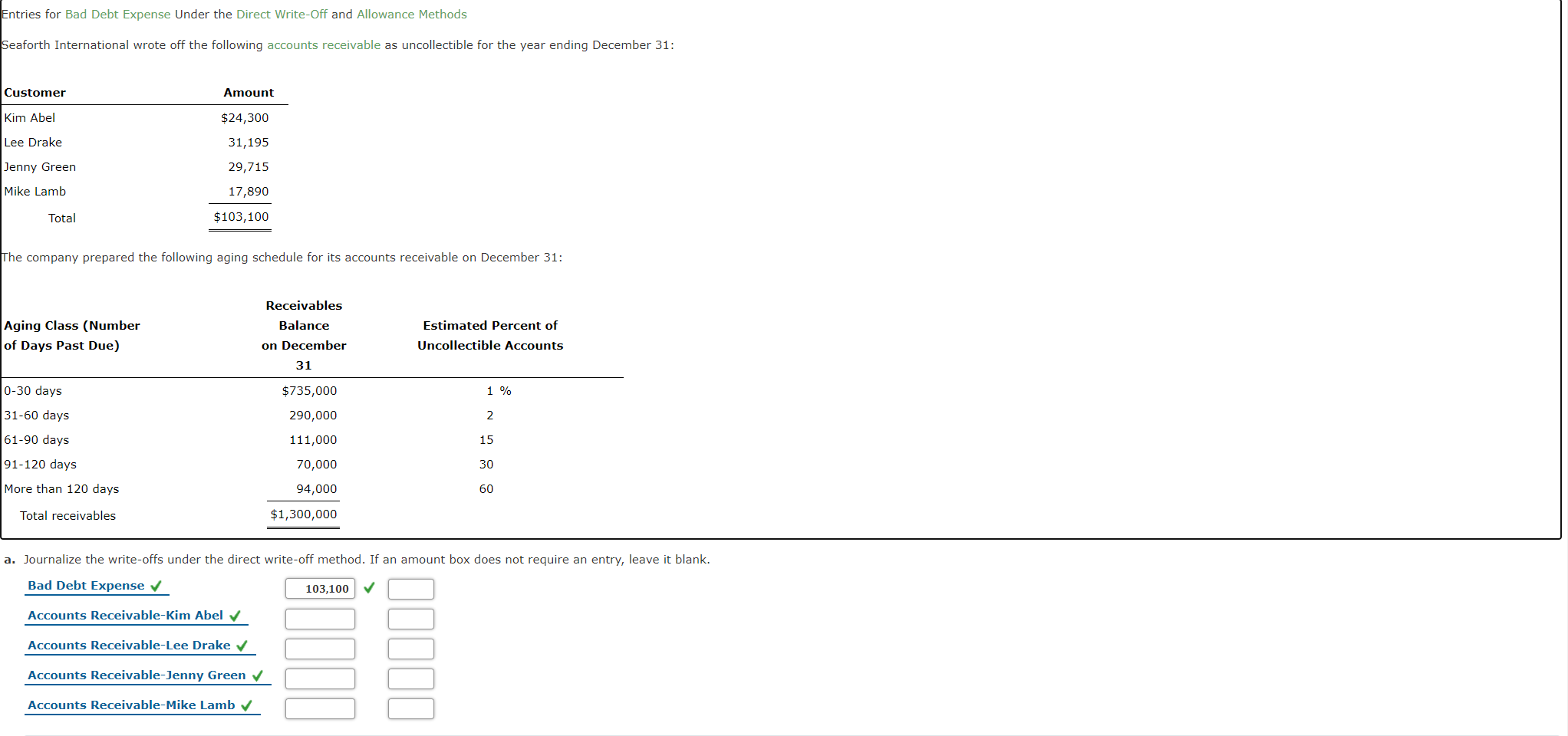

Question: Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year

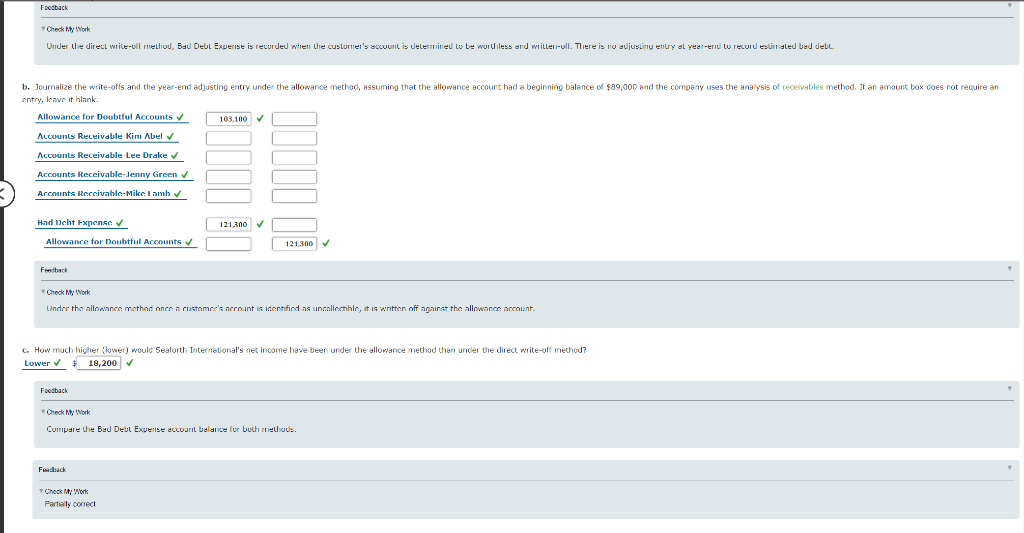

Entries for Bad Debt Expense Under the Direct Write-Off and Allowance Methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $24,300 Lee Drake 31,195 Jenny Green 29,715 Mike Lamb 17,890 Total $103,100 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts 0-30 days $735,000 1 % 290,000 2 31-60 days 61-90 days 111,000 15 91-120 days 70,000 30 More than 120 days 94,000 60 Total receivables $1,300,000 a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. Bad Debt Expense 103,100 Accounts Receivable-Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Foodbach Under the direct write-ul method, Bau Debl Expense is recorded wiren lire customer's account is decermined to be worthless and writler-oll. There is no sujusling entry al year-end to record estimated bed dell b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $99,000 and the company uses the analysis of receivables method. If an amount box does not require an antry, Innvr it blank. Allowance for Doubtful Accounts 103,100 Accounts Receivable Kim Abel Accounts Receivable Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Had Debt Expense 121.300 Allowance for Doubtful Accounts 121.300 Frestur Check My Work Under the allowance method once a customer's account is inentified as uncollectible, it is written off against the allowance account. C. How much higher lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? Lower 18,200 Feedback Check My Work Compare the Bud Deul Expense account balance for both methous. Fedha Check My Work Partially correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts