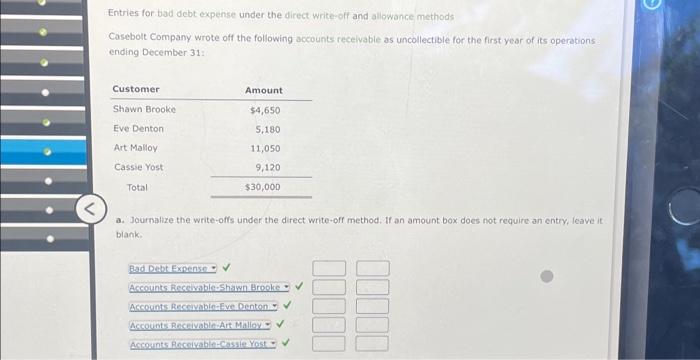

Question: Entries for bad debt expense under the direct write-off and allowance methods Casebolt Company wrote off the following accounts receivable as uncollectible for the first

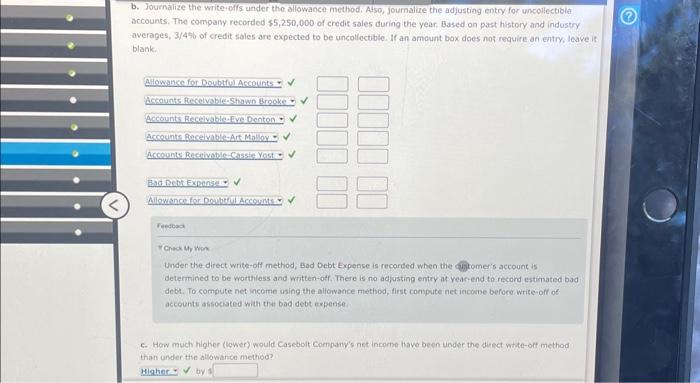

Entries for bad debt expense under the direct write-off and allowance methods Casebolt Company wrote off the following accounts recelvable as uncollectible for the first year of its operations. ending December 31 : a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave if blank. b. Journalize the write-offs under the allowance method. Atso, journalize the adjusting entry for uncollectible accounts. The company recorded \$5,250,000 of credit sales during the year. Based on past history and industry averages, 3/4\% of credit sales are expected to be uncollectible. If an amount box does not require an entry, Ieave it blank. feesoos roreck My Wors Under the-direct write-off method, Bad Debt Expense is recorded when the calsomer's account is determined to be worthless and written-off. There is no adjusting entry at veaf-end to record estimated bad debt. To compute net income using the aliowance method, first compute net income beforo write-off of accounts associated with the bad debt expense. c. How much higher (lower) would Caseboit Company's net income have been under the direct white-off method than under the allowance method? by 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts