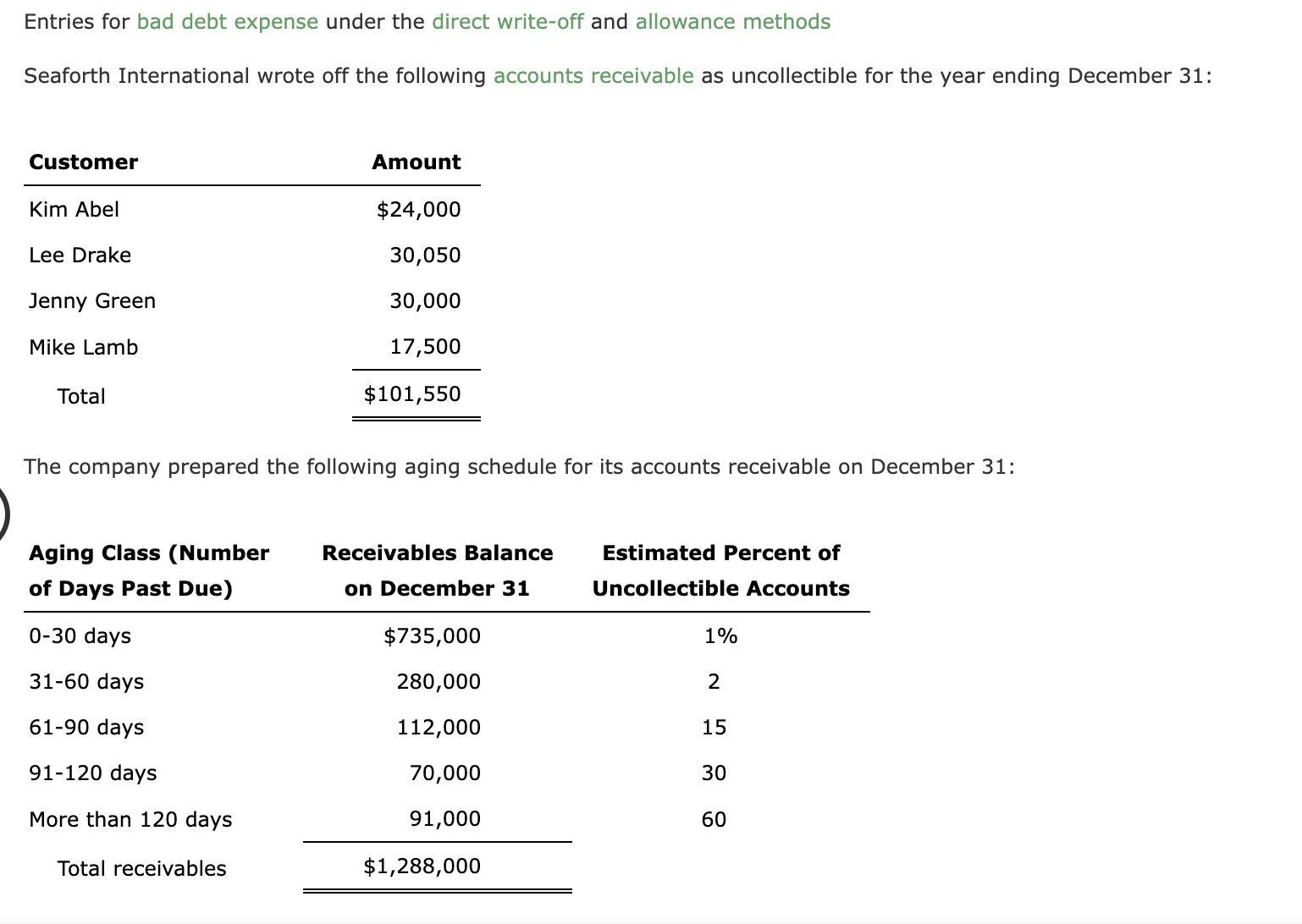

Question: Entries for bad debt expense under the direct write-off and allowance methods Seaforth International wrote off the following accounts receivable as uncollectible for the year

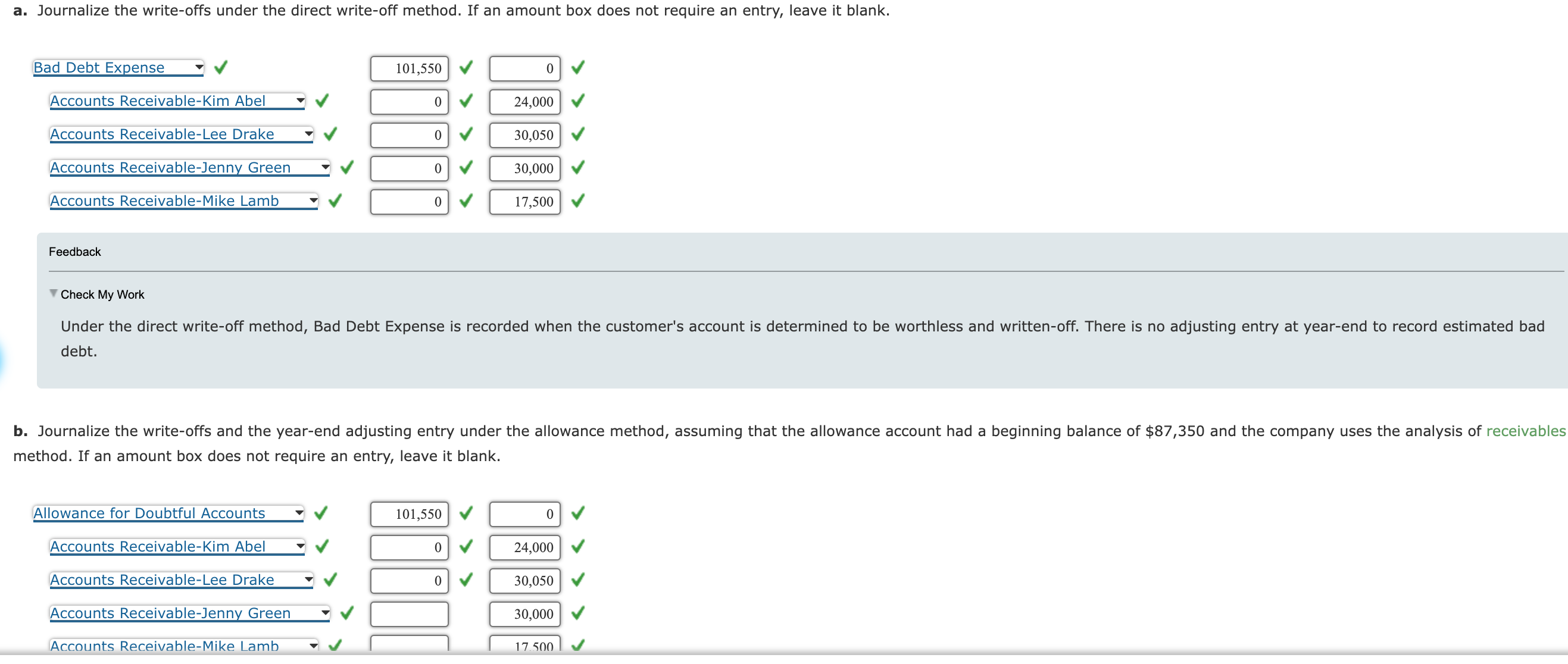

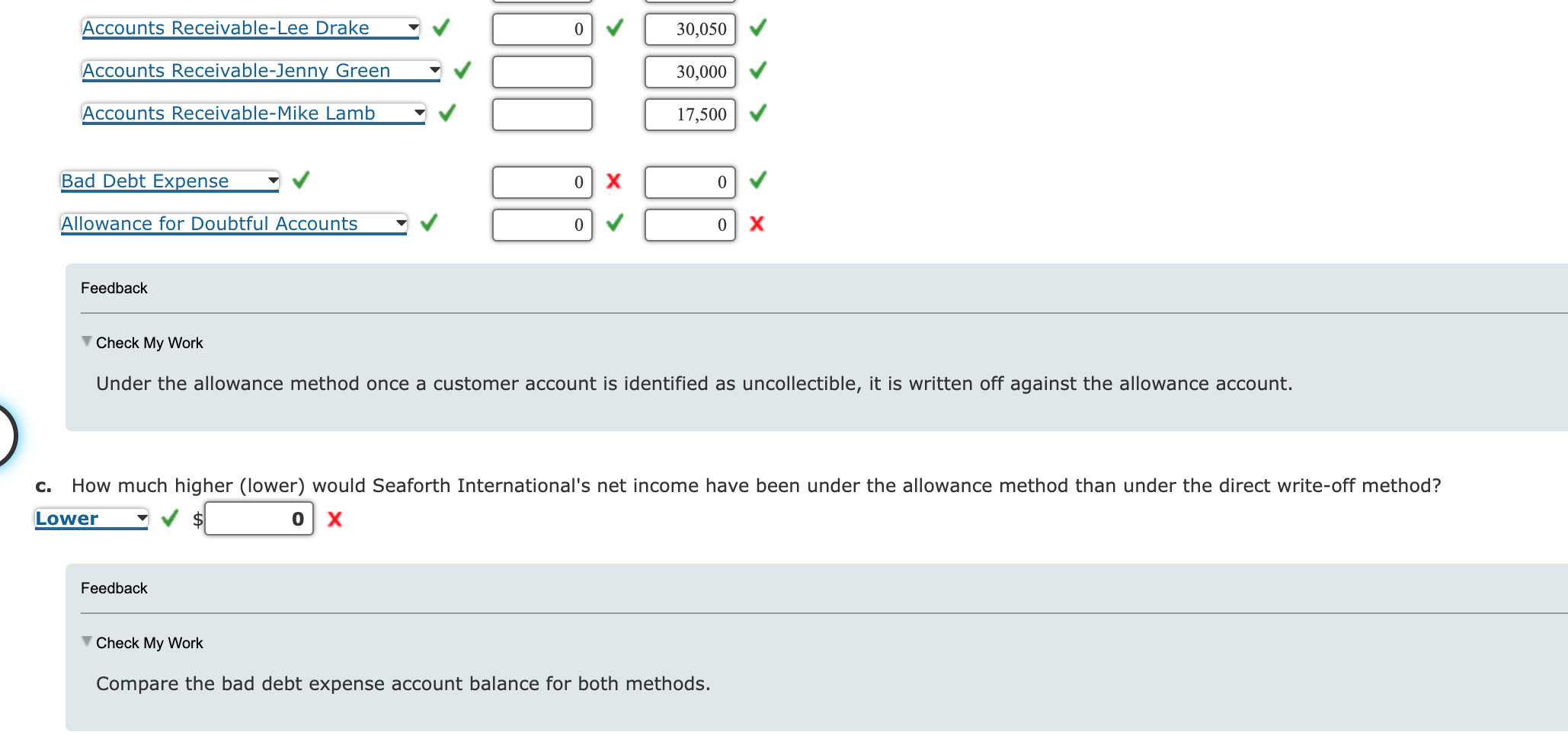

Entries for bad debt expense under the direct write-off and allowance methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel $24,000 Lee Drake 30,050 Jenny Green 30,000 Mike Lamb 17,500 Total $101,550 The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number Receivables Balance Estimated Percent of of Days Past Due) on December 31 Uncollectible Accounts 0-30 days $735,000 1% 31-60 days 280,000 2 61-90 days 112,000 15 91-120 days 70,000 30 More than 120 days 91,000 60 Total receivables $1,288,000a. Journalize the write-offs under the direct write-off method. If an amount box does not require an entry, leave it blank. Bad Debt Expense 101,550 V 0 Accounts Receivable-Kim Abel 24,000 Accounts Receivable-Lee Drake 30,050 Accounts Receivable-Jenny Green 30,000 Accounts Receivable-Mike Lamb 17,500 V Feedback Check My Work Under the direct write-off method, Bad Debt Expense is recorded when the customer's account is determined to be worthless and written-off. There is no adjusting entry at year-end to record estimated bad debt. b. Journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $87,350 and the company uses the analysis of receivables method. If an amount box does not require an entry, leave it blank. Allowance for Doubtful Accounts 101,550 Accounts Receivable-Kim Abel 24,000 Accounts Receivable-Lee Drake 30,050 Accounts Receivable-Jenny Green 30,000 Accounts Receivable-Mike Lamb 17.500Accounts ReceivableLee Drake V J E] J 3 050 4 Accounts ReceivableJenn! Green V J C] Accounts ReceivableMike Lamb V J S Bad Debt Expense V J E X E] J Allowance for Doubtful Accounts V w/ E J E] X Feedback V Check My Work Under the allowance method once a customer account is identied as uncollectible, it is written off against the allowance account. ) c. How much higher (lower) would Seaforth International's net income have been under the allowance method than under the direct write-off method? Lower V J $5] X Feedback V Check My Work Compare the bad debt expense account balance for both methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts