Question: Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $46,500 on a corporation's common stock are January

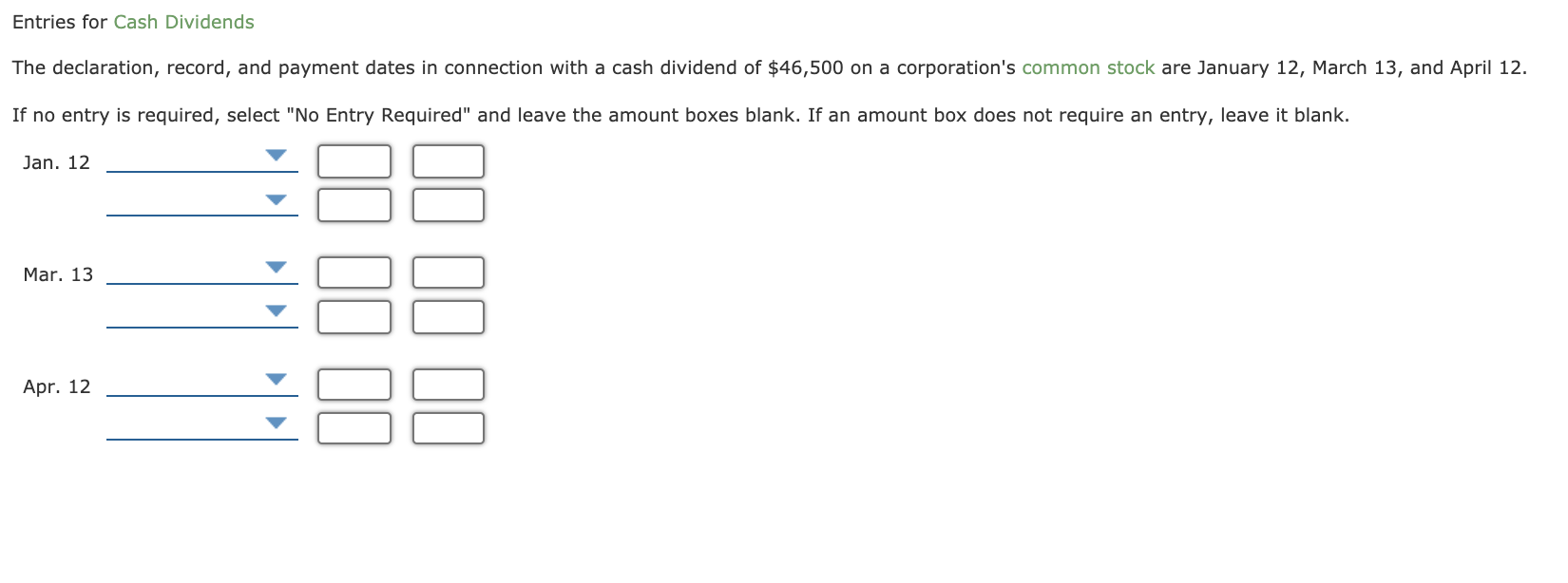

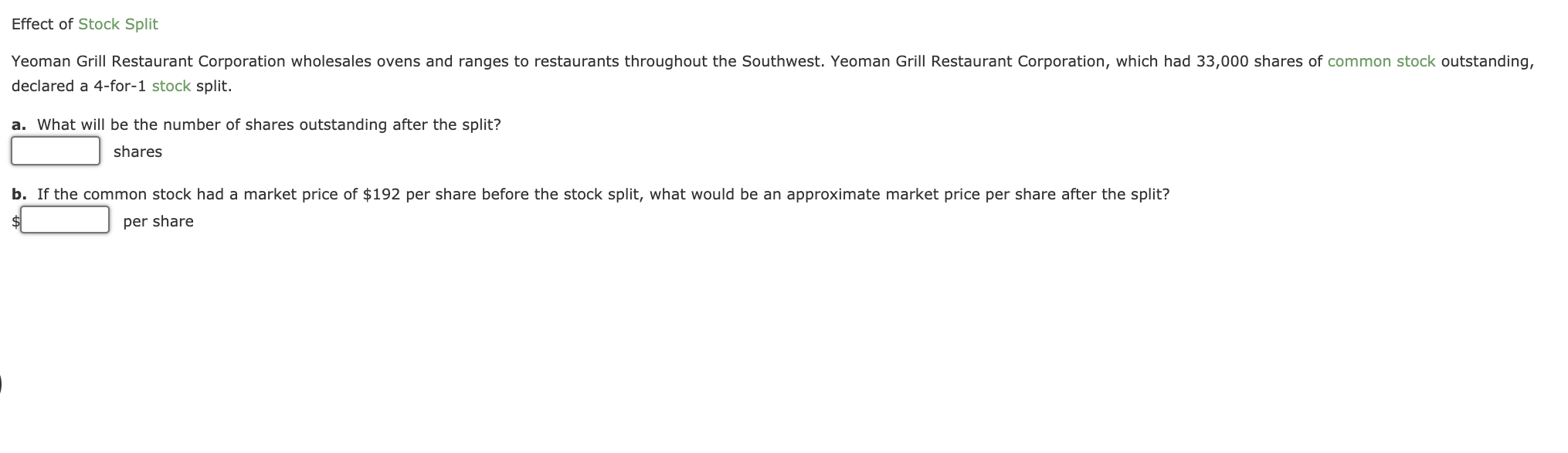

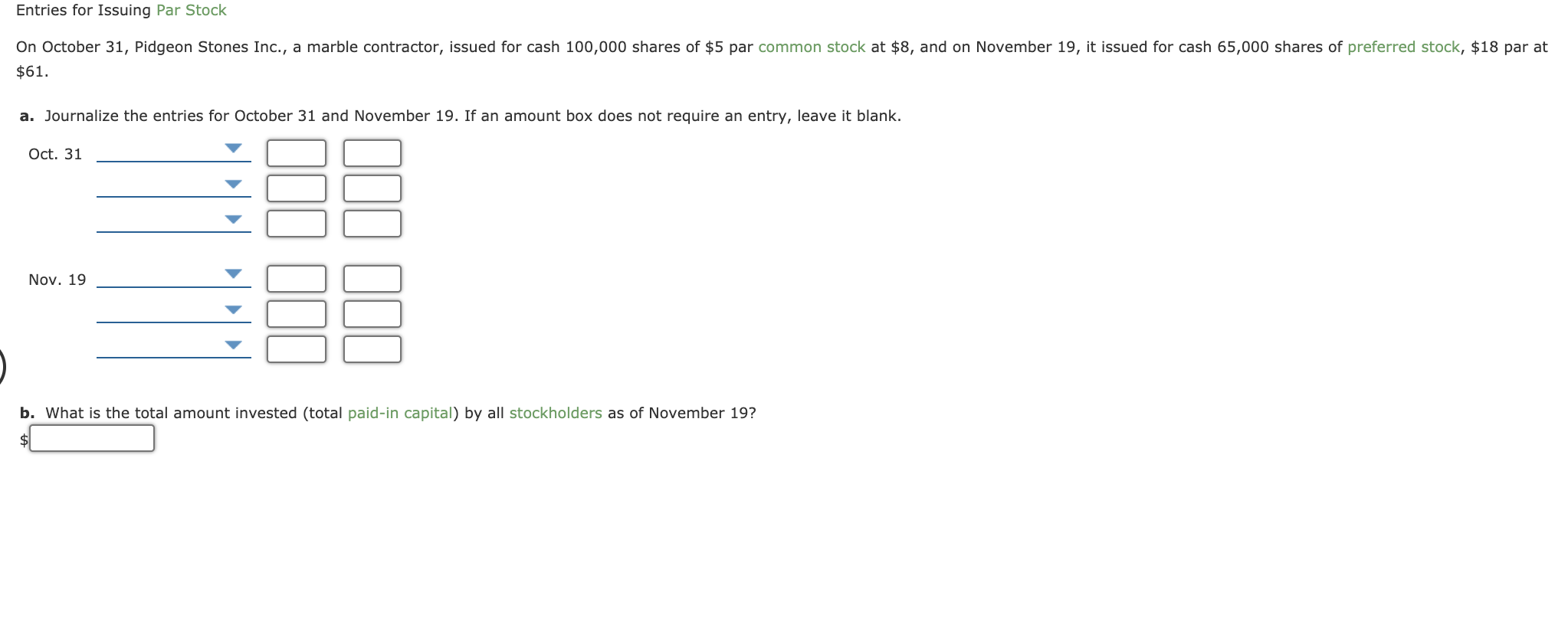

Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $46,500 on a corporation's common stock are January 12, March 13, and April 12. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 12 Mar. 13 II II ll Apr. 12 Effect of Stock Split Yeoman Grill Restaurant Corporation wholesales ovens and ranges to restaurants throughout the Southwest. Yeoman Grill Restaurant Corporation, which had 33,000 shares of common stock outstanding, declared a 4-for-1 stock split. a. What will be the number of shares outstanding after the split? shares b. If the common stock had a market price of $192 per share before the stock split, what would be an approximate market price per share after the split? $ per share Entries for Issuing Par Stock On October 31, Pidgeon Stones Inc., a marble contractor, issued for cash 100,000 shares of $5 par common stock at $8, and on November 19, it issued for cash 65,000 shares of preferred stock, $18 par at $61. a. Journalize the entries for October 31 and November 19. If an amount box does not require an entry, leave it blank. Oct. 31 Nov. 19 b. What is the total amount invested (total paid-in capital) by all stockholders as of November 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts