Question: Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $375,000 on a corporation's common stock are October

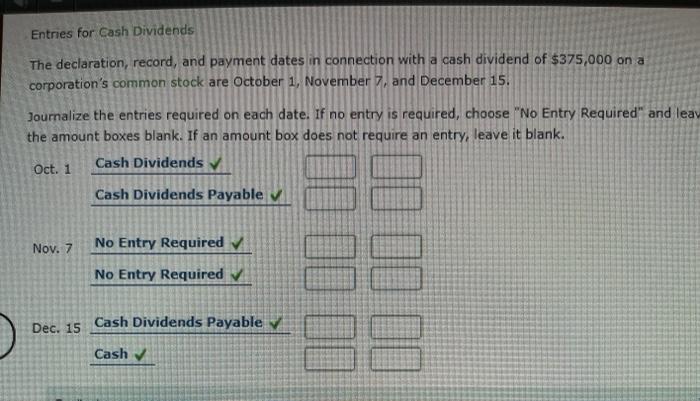

Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $375,000 on a corporation's common stock are October 1, November 7, and December 15. Journalize the entries required on each date. If no entry is required, choose "No Entry Required" and leav the amount boxes blank. If an amount box does not require an entry, leave it blank. Oct. 1 Cash Dividends Cash Dividends Payable Nov. 7 No Entry Required No Entry Required Dec. 15 Cash Dividends Payable Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts