Question: Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $68,000 on a corporation's common stock are February

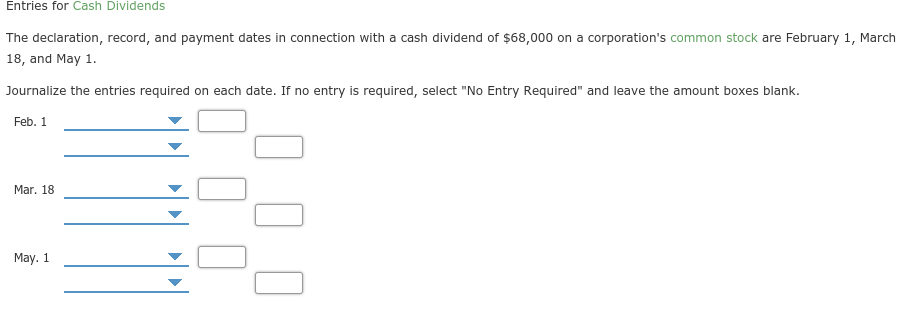

Entries for Cash Dividends

The declaration, record, and payment dates in connection with a cash dividend of $68,000 on a corporation's common stock are February 1, March 18, and May 1.

Journalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank.

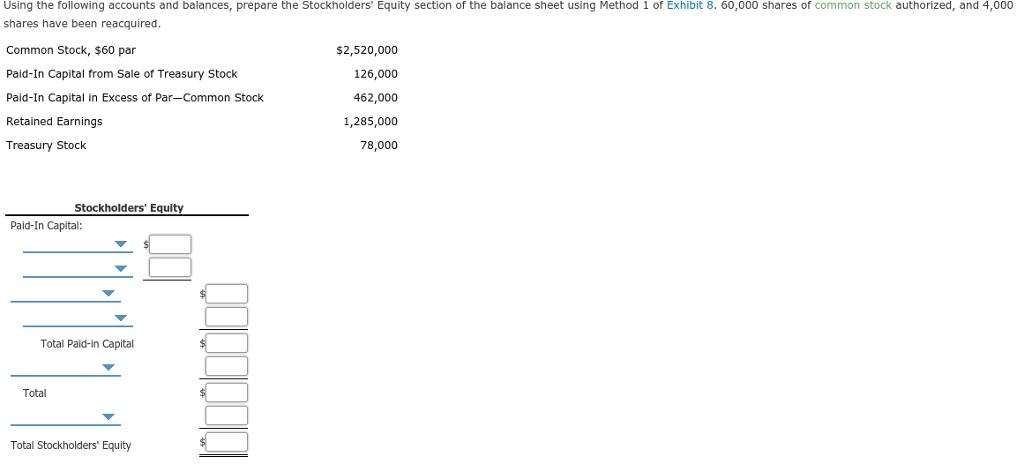

Reporting Stockholders' Equity

Using the following accounts and balances, prepare the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. 60,000 shares of common stock authorized, and 4,000 shares have been reacquired.

| Common Stock, $60 par | $2,520,000 | |

| Paid-In Capital from Sale of Treasury Stock | 126,000 | |

| Paid-In Capital in Excess of ParCommon Stock | 462,000 | |

| Retained Earnings | 1,285,000 | |

| Treasury Stock | 78,000 | |

Entries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $68,000 on a corporation's common stock are February 1, March 18, and May 1 Journalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank Feb. 1 Mar. 18 May. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts