Question: Entries for installment Note Transactions On January 1, Year 1, Wedekind Company issued a $52,000, 4-year, 11% installment note to Shannon Bank. The note requires

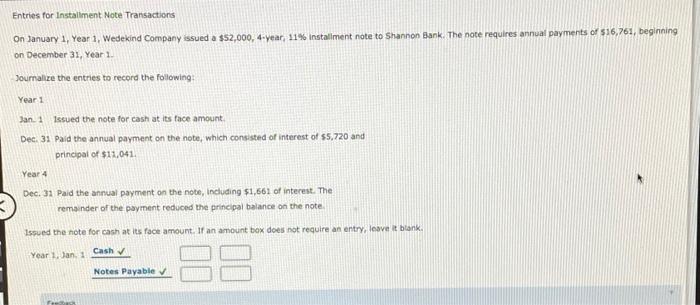

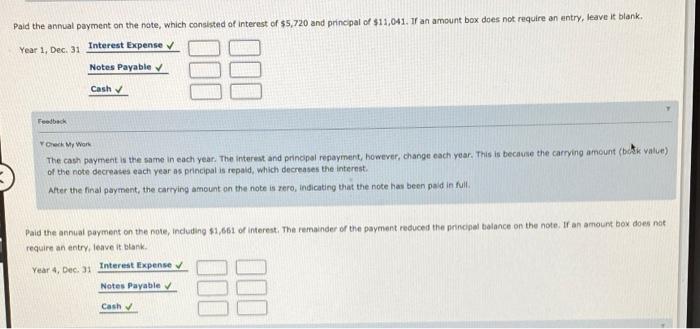

Entries for installment Note Transactions On January 1, Year 1, Wedekind Company issued a $52,000, 4-year, 11% installment note to Shannon Bank. The note requires annual payments of $16,761, beginning on December 31, Year 1 Journalize the entries to record the following: Year 1 Jan 1 Issued the note for cash at its face amount Dec. 31 Paid the annual payment on the note, which consisted of interest of $5,720 and principal of $11.041 Year 4 Dec. 31 Paid the annual payment on the note, including $1,661 of interest. The remainder of the payment reduced the principal balance on the note Issued the note for cash at its face amount. If an amount box does not require an entry, leave it bank Year 1. Jan. 1 Cash 88 Notes Payable Paid the annual payment on the note, which consisted of interest of $5,720 and principal of $11,041.1 an amount box does not require an entry, leave it blank. Year 1, Dec. 31 Interest Expense Notes Payable Cash Feedback Check My Work The cash payment is the same in each year. The interest and principal repayment, however, change each year. This is because the carrying amount (bick value) of the note decreases each year as principal is repaid, which decreases the interest After the final payment, the carrying amount on the note is rero, indicating that the note has been paid in full Paid the annual payment on the note, including $1,661 of interest. The remainder of the payment reduced the principal balance on the note. Ir an amount box does not require an entry leave it blank Year 4, Dec. 21 Interest Expense Notes Payable 111 110 Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts