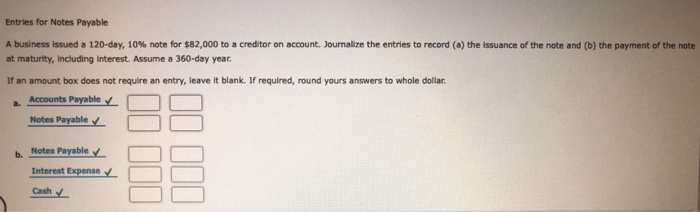

Question: Entries for Notes Payable A business issued a 120-day, 10% note for $82,000 to a creditor on account. Journalize the entries to record(a) the issuance

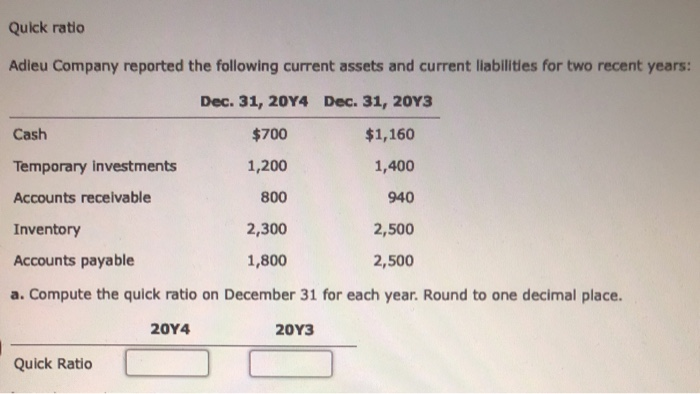

Entries for Notes Payable A business issued a 120-day, 10% note for $82,000 to a creditor on account. Journalize the entries to record(a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360-day year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar. a Accounts Payable Notes Payable N L Notes Payable Interest Expense Cash Quick ratio Adieu Company reported the following current assets and current liabilities for two recent years: Dec. 31, 2014 Dec. 31, 20Y3 $700 1,200 940 Cash $1,160 Temporary investments 1,400 Accounts receivable 800 Inventory 2,300 2,500 Accounts payable 1,800 2,500 a. Compute the quick ratio on December 31 for each year. Round to one decimal place. 2014 20Y3 Quick Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts