Question: Entries under Direct Write-Off Method A retailer uses the direct write-off method. Record the following transactions. Feb. 14 The retailer determines that it cannot collect

Entries under Direct Write-Off Method

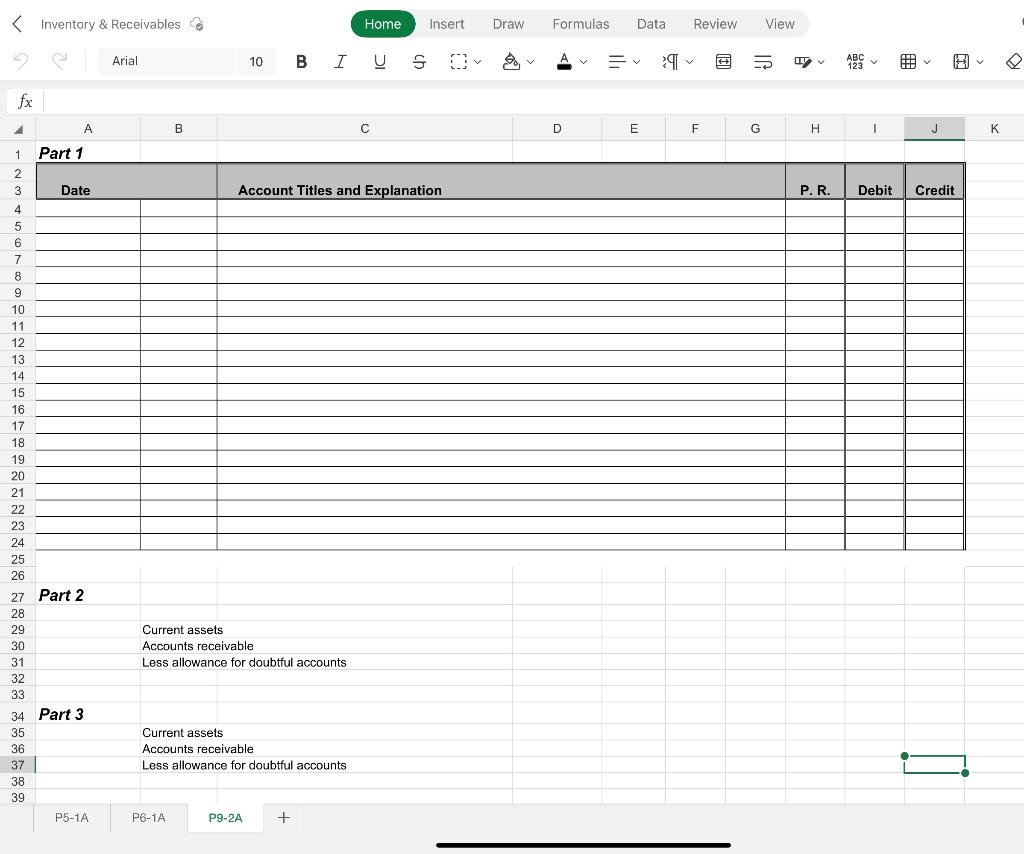

A retailer uses the direct write-off method. Record the following transactions.

Feb. 14 The retailer determines that it cannot collect $400 of its accounts receivable from a customer named ZZZ Company.

Apr. 1 ZZZ Company unexpectedly pays its account in full to the retailer, which then records its recovery of this bad debt. Post the balance from the entries into T-accounts and solve Part 2 and Part 3. Please Use The Excel Template Below.

Part 2

Current Assets

Accounts Receivable

Less Allowance For Doubtful Accounts

Part 3

Current Assets

Accounts Receivable

Less Allowance For Doubtful Accounts

| Feb. 14 | Bad Debts Expense | 400 | |

| Accounts Receivable - ZZZ Co. | 400 | ||

| Write off an account. | |||

| Apr. 1 | Accounts Receivable - ZZZ Co. | 400 | |

| Bad Debts Expense | 400 | ||

| Reinstate an account previously written off. | |||

| Apr. 1 | Cash | 400 | |

| Accounts Receivable - ZZZ Co. | 400 | ||

| Record cash received on credit. |

Part 2 Part 3 Current assets Less allowance for doubtful accounts Part 3 Current assets Accounts receivable Less allowance for doubtful accounts \begin{tabular}{l|l|lll} P5-1A & P6-1A & P9-2A & + \\ \hline \end{tabular} Part 2 Part 3 Current assets Less allowance for doubtful accounts Part 3 Current assets Accounts receivable Less allowance for doubtful accounts \begin{tabular}{l|l|lll} P5-1A & P6-1A & P9-2A & + \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts