Question: entry level finance question Problem 4 and 5-1 Future Value 12 25 points Consider that you are 45 years old and have just changed to

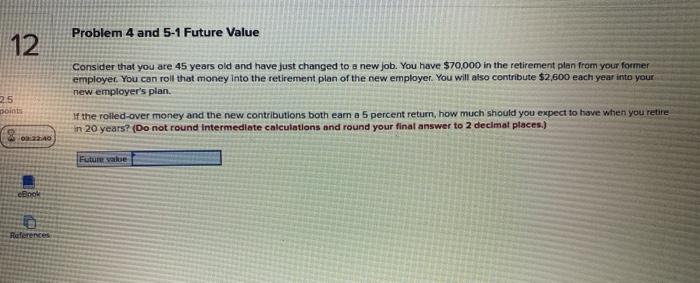

Problem 4 and 5-1 Future Value 12 25 points Consider that you are 45 years old and have just changed to a new job. You have $70,000 in the retirement plan from your former employer. You can roll that money into the retirement plan of the new employer. You will also contribute $2,600 each year into your new employer's plan. If the rolled-over money and the new contributions both eam a 5 percent return, how much should you expect to have when you retire in 20 years? (Do not round Intermediate calculations and round your final answer to 2 decimal places.) 40 Futun vake eBook References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts