Question: ENTS 2019 MCOM ACCOUNTING.pl - Adobe Acrobat DC w Help ACCA Strategic Bu. INDIVIDUAL ASSIG. * ......... 1. le B. MAAC513 You are looking at

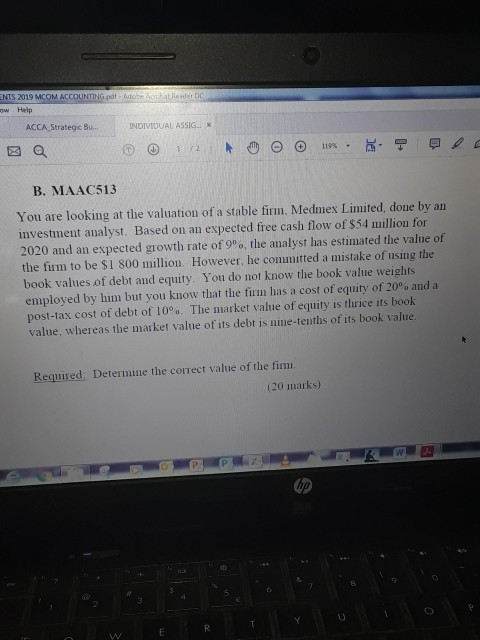

ENTS 2019 MCOM ACCOUNTING.pl - Adobe Acrobat DC w Help ACCA Strategic Bu. INDIVIDUAL ASSIG. * ......... 1. le B. MAAC513 You are looking at the valuation of a stable firm. Medmex Limited, done by an investment analyst. Based on an expected free cash flow of $54 million for 2020 and an expected growth rate of the analyst has estimated the value of the firm to be $1 800 million. However, he committed a mistake of using the book values of debt and equity. You do not know the book value weights employed by him but you know that the firm has a cost of equity of 20' and a post-tax cost of debt of 10%. The market value of equity is thrice its book value, whereas the market value of its debt is nine-tenths of its book value. Required: Determine the correct value of the fimi (20 marks) R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts