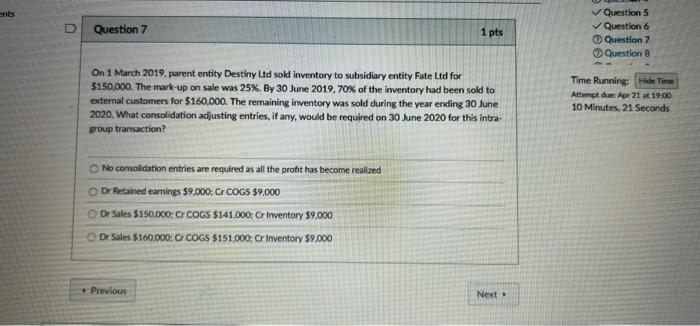

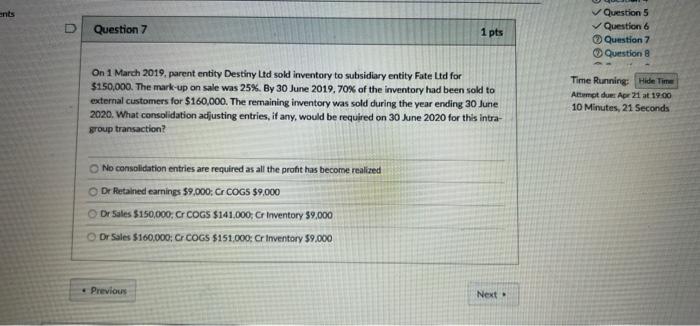

Question: ents Question 7 1 pts Question 5 Question 6 Question 7 Question 8 On 1 March 2019.parent entity Destiny Lid sold inventory to subsidiary entity

ents Question 7 1 pts Question 5 Question 6 Question 7 Question 8 On 1 March 2019.parent entity Destiny Lid sold inventory to subsidiary entity Fate Ltd for $150,000. The mark-up on sale was 25%. By 30 June 2019, 70% of the inventory had been sold to external customers for $160,000. The remaining inventory was sold during the year ending 30 June 2020. What consolidation adjusting entries, if any, would be required on 30 June 2020 for this intra- group transaction? Time Running Hide Time Al mot due Apr 21 at 19.00 10 Minutes, 21 Seconds No consolidation entries are required as all the profit has become realized De Retained earnings 59,000 Cr COGS $9,000 Dr Sale $150,000.CCOGS $141.000 Cr Inventory 39,000 Dr Sales $160,000: CCOGS $151.000: Cr Inventory $9.000 Previous Next ents Question 7 1 pts Question 5 Question 6 Question 7 Question 8 On 1 March 2019.parent entity Destiny Lid sold inventory to subsidiary entity Fate Ltd for $150,000. The mark-up on sale was 25%. By 30 June 2019, 70% of the inventory had been sold to external customers for $160,000. The remaining inventory was sold during the year ending 30 June 2020. What consolidation adjusting entries, if any, would be required on 30 June 2020 for this intra- group transaction? Time Running Hide Time Al mot due Apr 21 at 19.00 10 Minutes, 21 Seconds No consolidation entries are required as all the profit has become realized De Retained earnings 59,000 Cr COGS $9,000 Dr Sale $150,000.CCOGS $141.000 Cr Inventory 39,000 Dr Sales $160,000: CCOGS $151.000: Cr Inventory $9.000 Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts