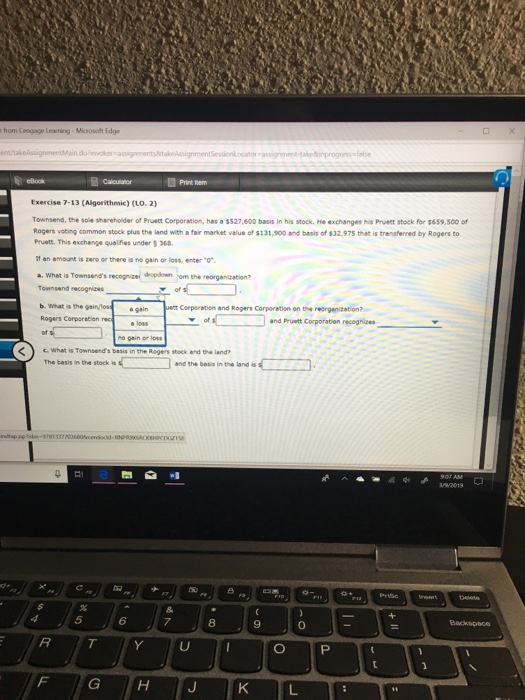

Question: entu/takeAssignmentMain dowokerassignmentstakeAssignment Print tem Exercise 7-13 (Algorithmic) (LO. 2) Townsend, the sole shareholder of Pruett Corporation, has a $527,600 basis in his stock. He exchanges

entu/takeAssignmentMain dowokerassignmentstakeAssignment Print tem Exercise 7-13 (Algorithmic) (LO. 2) Townsend, the sole shareholder of Pruett Corporation, has a $527,600 basis in his stock. He exchanges his Prueet stock for $659,500 of Rogers voting common stock plus the land with far market value of S13.900 are basis of 132.975 that is transferred by Rogers to Pruett. This exchange qualifies under 9 36 If an amount is zero or there is no gain or loss, enter o a. Whaet is Townsends Townsend recogzis b. What is the gain/loss again et Corporation and Rogers Corporation on the reorganization? Rogers Corporation rec ) what is Townsend's basis in the Rogers stock The basis in the stock is be land? and the basis in the land is 5 2019 8 9 0 Backspace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts