Question: eolBet agaunst expected changes in exchange rates Multiple Choice 3) 1. Owning an insurance company can be described as a. buying puts b. selling puts

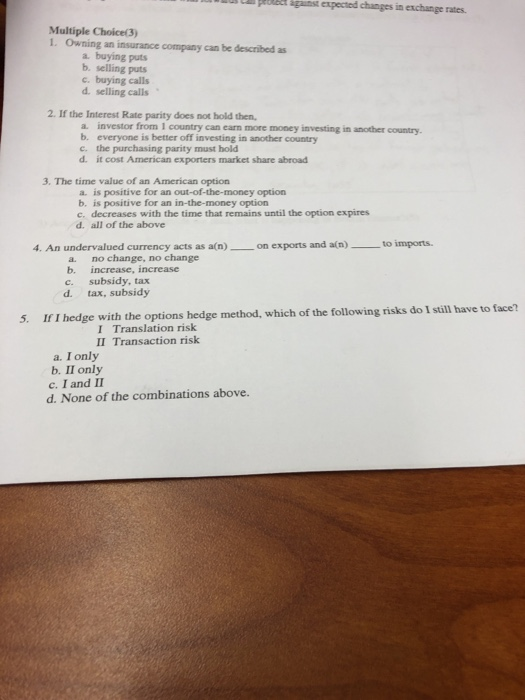

eolBet agaunst expected changes in exchange rates Multiple Choice 3) 1. Owning an insurance company can be described as a. buying puts b. selling puts c. buying calls d. selling calls 2. If the Interest Rate parity does not hold then a. investor from 1 country can earn more money investing in another country b. everyone is better off investing in another country C, the purchasing party must hold d. it cost American exporters market share abroad 3. The time value of an American option a. is positive for an out-of-the-money option b. is positive for an in-the-money option c, decreases with the time that remains until the option expires d. all of the above 4. An undervalued currency acts as a(n)on exports and a(n)to imports. a. no change, no change b. increase, increase c. subsidy, tax d. tax, subsidy 5. If I hedge with the options hedge method, which of the following risks do I still have to face? I Translation risk II Transaction risk a. I only b. II only c. I and II d. None of the combinations above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts