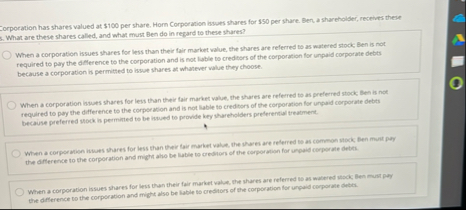

Question: Eorpocation has shares valued at $ 1 0 0 per share. Horn Corporation iswoes shares for $ 5 0 per share. Ben, a shareholder, receives

Eorpocation has shares valued at $ per share. Horn Corporation iswoes shares for $ per share. Ben, a shareholder, receives these

What are these shares called, and what must Ben do in regard to these shares? required to pay the dillerence to the corporation and is not lable to credivors of the corporation for unpaid corporate debts because a corporation is permitted to issue shares at whatever value they choose.

When a corporation iawes shares for less than their fair market value, the shares ave referred to as preferred atock Ben is not required to pay the difference to the corporation and is not liable to credinors of the corporation for unpaid corporate debts because preferted shork is perminted to be inwed to provide hey thareholders preferential treatment.

When a corporation inwes whares for less than they fair market value, the ihares are relerred as as common stack, lien mult pery the difference to the corporation and might aho be liatie to credhors of the corporation for unpaid corporate debth.

When a corporation issues shares for less than their fair market valat, he flares srt refereet as as wabered stock: Ben must pay the diflerence to the corporation and might also be liable to creditors of the corporation for ungaid corporate debts.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock