Question: epts, 2 nd Edition, Revised Online Certification Exam Annuity Concepts, 2 nd Edition, Revised Online Certification Exam 0 0 : 5 2 : 4 0

epts, nd Edition, Revised Online Certification Exam

Annuity Concepts, nd Edition, Revised Online Certification Exam

::

Test Id:

Question # of

Question ID:

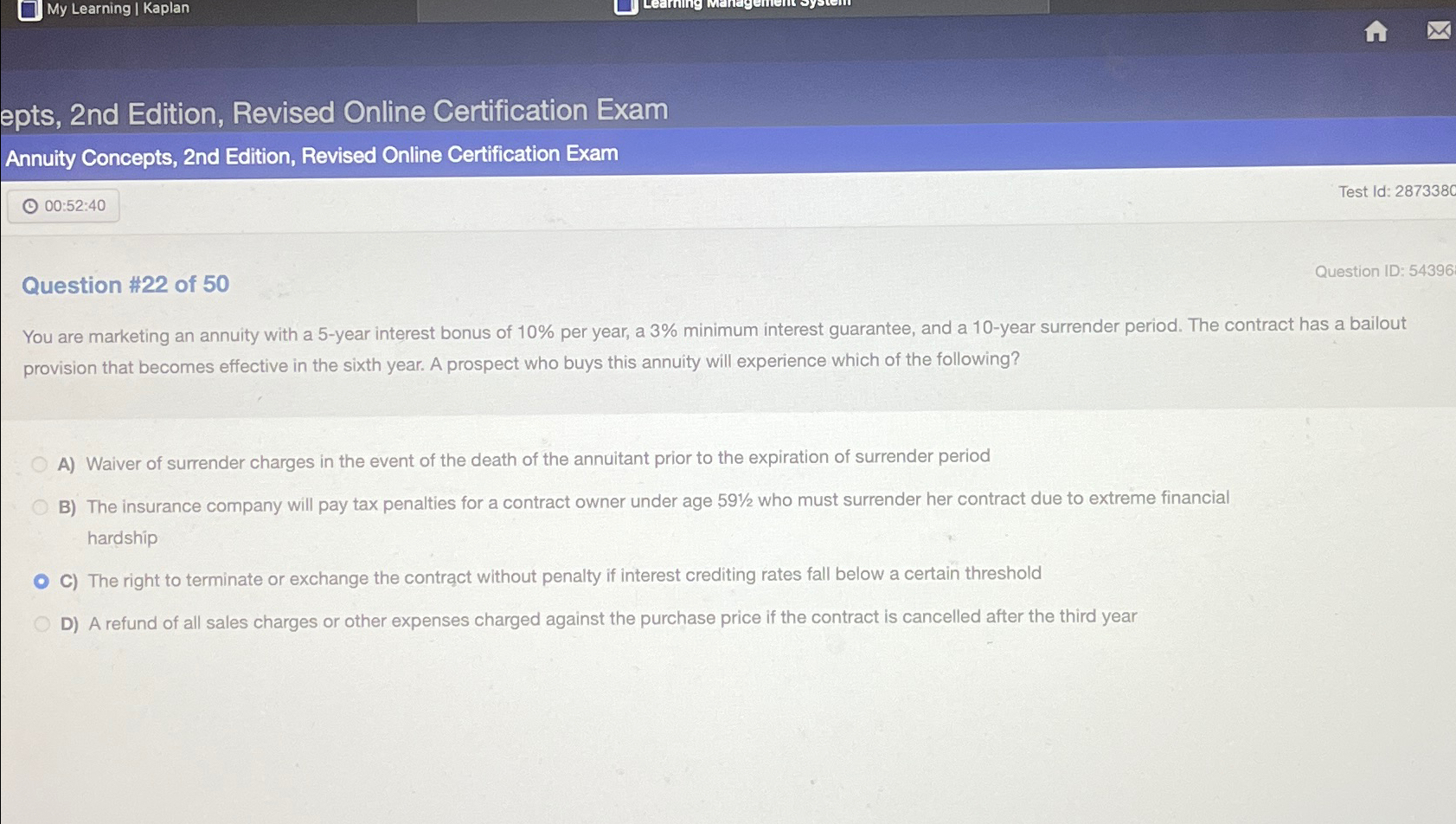

You are marketing an annuity with a year interest bonus of per year, a minimum interest guarantee, and a year surrender period. The contract has a bailout provision that becomes effective in the sixth year. A prospect who buys this annuity will experience which of the following?

A Waiver of surrender charges in the event of the death of the annuitant prior to the expiration of surrender period

B The insurance company will pay tax penalties for a contract owner under age who must surrender her contract due to extreme financial hardship

C The right to terminate or exchange the contract without penalty if interest crediting rates fall below a certain threshold

D A refund of all sales charges or other expenses charged against the purchase price if the contract is cancelled after the third year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock