Question: EQM Corp. issues convertible bonds with a US$ 1,000 par value per bond that is 5 years to maturity and has a 4% coupon (annual

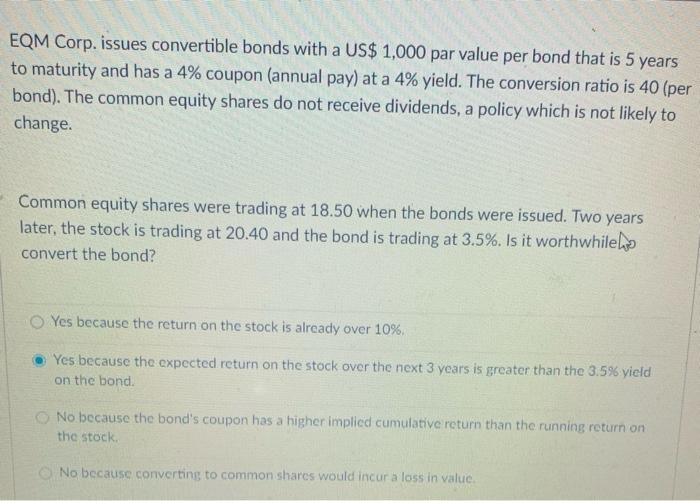

EQM Corp. issues convertible bonds with a US$ 1,000 par value per bond that is 5 years to maturity and has a 4% coupon (annual pay) at a 4% yield. The conversion ratio is 40 (per bond). The common equity shares do not receive dividends, a policy which is not likely to change Common equity shares were trading at 18.50 when the bonds were issued. Two years later, the stock is trading at 20.40 and the bond is trading at 3.5%. Is it worthwhile hos convert the bond? Yes because the return on the stock is already over 10%. . Yes because the expected return on the stock over the next 3 years is greater than the 3.5% yield on the bond No because the bond's coupon has a higher implied cumulative return than the running return on the stock No because converting to common shares would incur a loss in value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts