Question: EQUATIONS DROP DOWN OPTIONS 1. (28%, 25% 19.50%) 2. (19.50%, 29.20%, 20.565) 3. (25.00%, 16.67% 15.00%) 4. (18.53%, 16.67%, 29.20%) QUESTIONS: Calculating Tax Liability Chloe

EQUATIONS

DROP DOWN OPTIONS

1. (28%, 25% 19.50%)

2. (19.50%, 29.20%, 20.565)

3. (25.00%, 16.67% 15.00%)

4. (18.53%, 16.67%, 29.20%)

QUESTIONS:

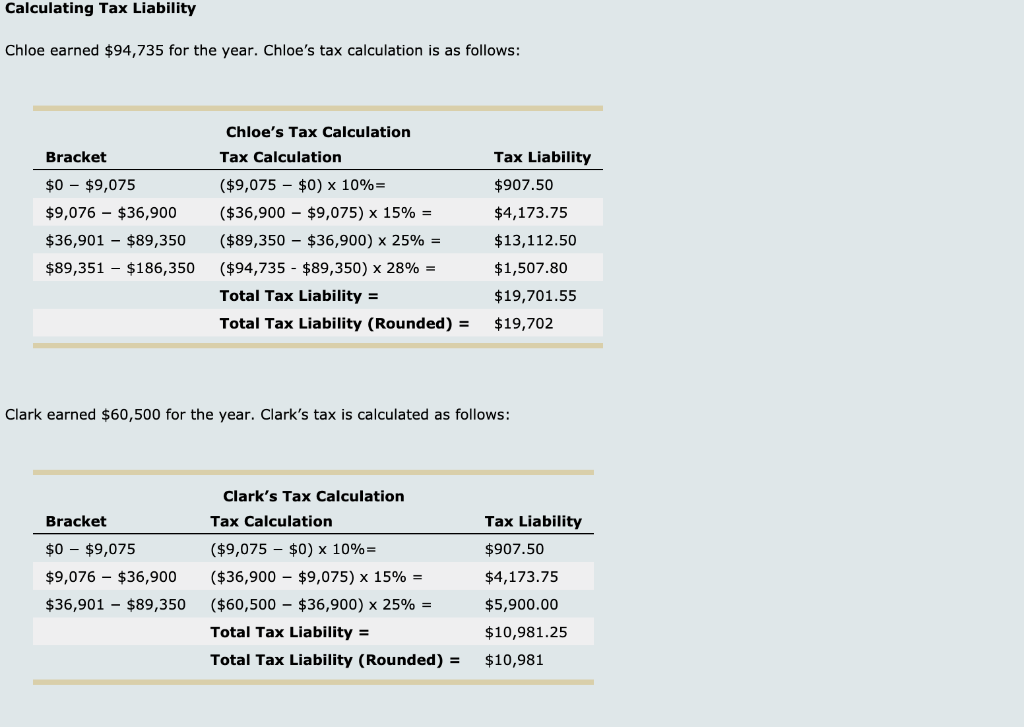

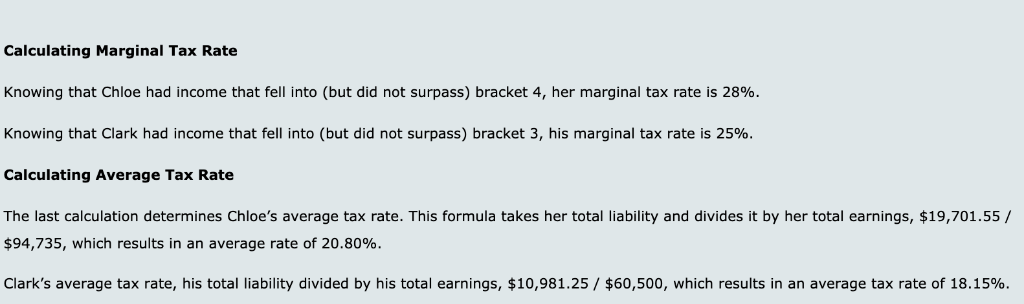

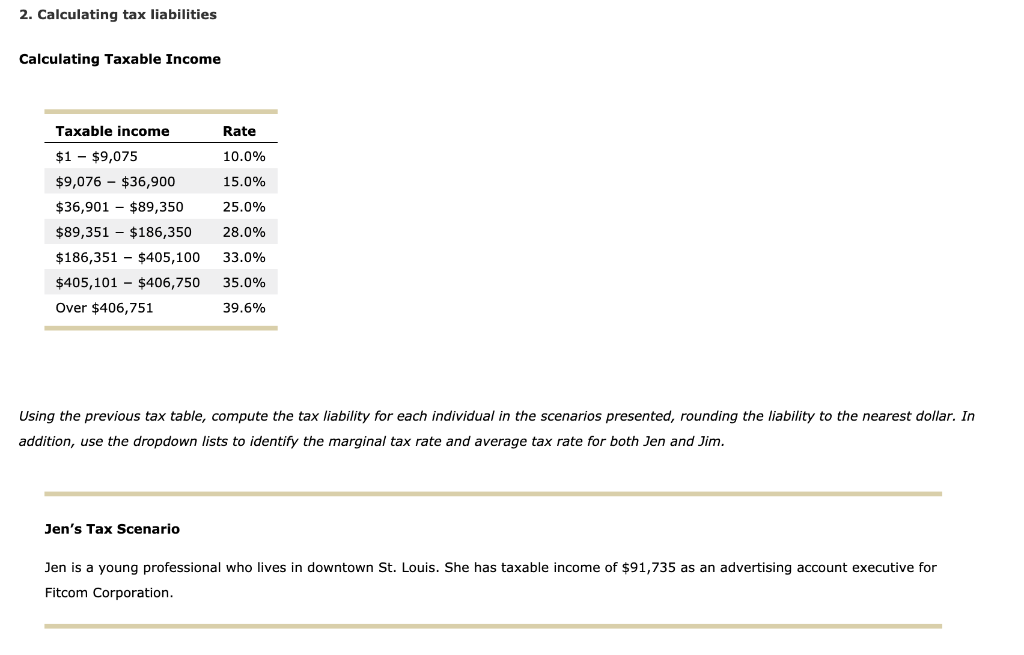

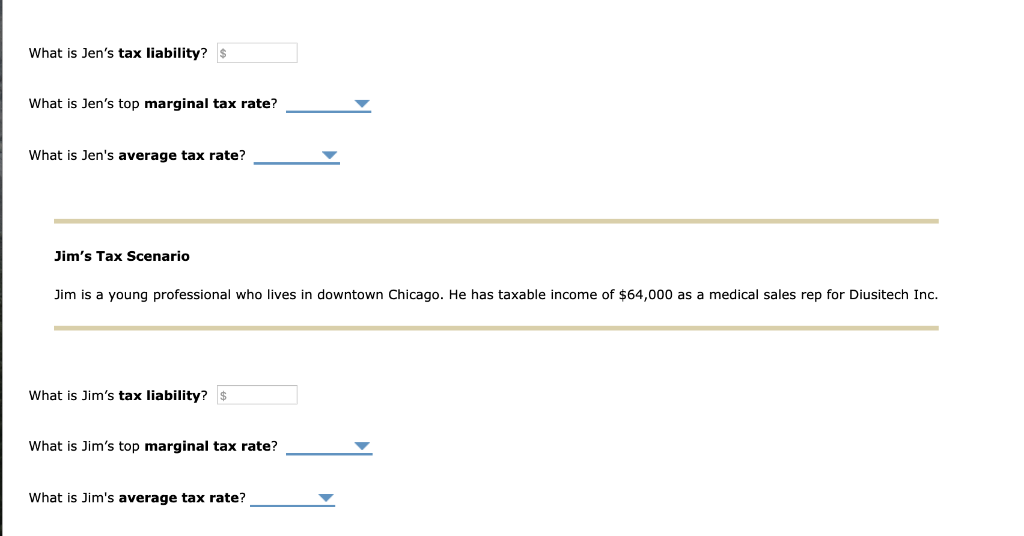

Calculating Tax Liability Chloe earned $94,735 for the year. Chloe's tax calculation is as follows: Chloe's Tax Calculation Tax Liability Bracket Tax Calculation $0 - $9,075 ($9,075 _ $0) x 10%= $907.50 $9,076 _ $36,900 ($36,900-$9,075) x 15% = $4,173.75 $36,901 _ $89,350 ($89,350 _ $36,900) x 2596 $13,112.50 $89,351 _ $186,350 ($94,735-$89,350) x 28% $1,507.80 Total Tax Liability = $19,701.55 Total Tax Liability (Rounded)$19,702 Clark earned $60,500 for the year. Clark's tax is calculated as follows: Clark's Tax Calculation Bracket Tax Calculation Tax Liability $0 - $9,075 ($9,075 _ $0) x 10%- $907.50 $9,076 _ $36,900 ($36,900-$9,075) x 15% $4,173.75 $36,901 - $89,350 ($60,500 $36,900) x 25% - $5,900.00 Total Tax Liability $10,981.25 Total Tax Liability (Rounded) $%10,981 Calculating Marginal Tax Rate Knowing that Chloe had income that fell into (but did not surpass) bracket 4, her marginal tax rate is 28% Knowing that Clark had income that fell into (but did not surpass) bracket 3, his marginal tax rate is 25% Calculating Average Tax Rate The last calculation determines Chloe's average tax rate. This formula takes her total liability and divides it by her total earnings, $19,701.55/ $94,735, which results in an average rate of 20.80% Clark's average tax rate, his total liability divided by his total earnings, $10,981.25 /60,500, which results in an average tax rate of 18.15% 2. Calculating tax liabilities Calculating Taxable Income Taxable income Rate $1$9,075 10.0% $9,076-$36,900 15.0% $36,901 - $89,350 25.0% $89,351 _ $186,350 28.0% $186,351-$405,100 33.0% $405,101-$406,750 35.0% 39.6% Over $406,751 Using the previous tax table, compute the tax liability for each individual in the scenarios presented, rounding the liability to the nearest dollar. In addition, use the dropdown lists to identify the marginal tax rate and average tax rate for both Jen and Jim. Jen's Tax Scenario Jen is a young professional who lives in downtown St. Louis. She has taxable income of $91,735 as an advertising account executive for Fitcom Corporation. What is Jen's tax liability? What is Jen's top marginal tax rate? What is Jen's average tax rate? Jim's Tax Scenario Jim is a young professional who lives in downtown Chicago. He has taxable income of $64,000 as a medical sales rep for Diusitech Inc. What is Jim's tax liability?$ What is Jim's top marginal tax rate? What is Jim's average tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts