Question: equired: a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum

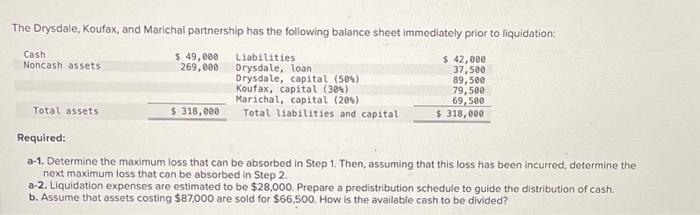

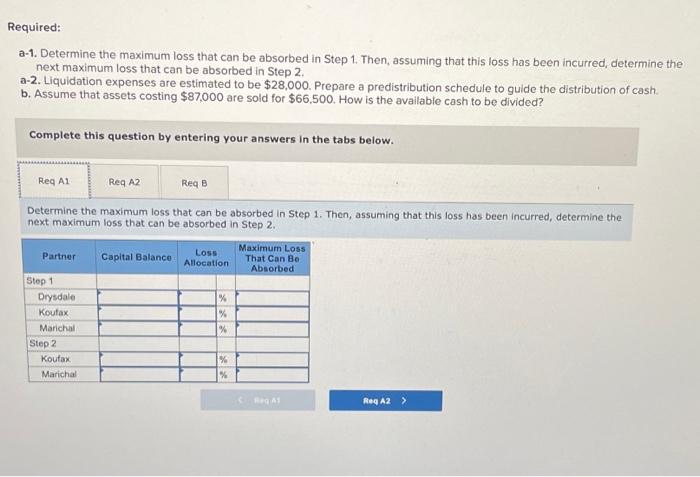

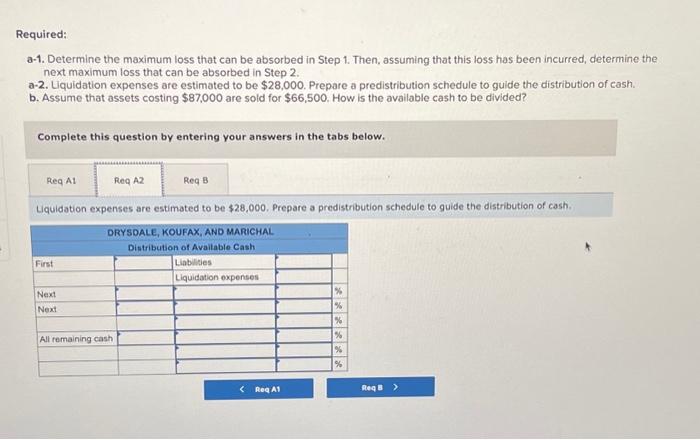

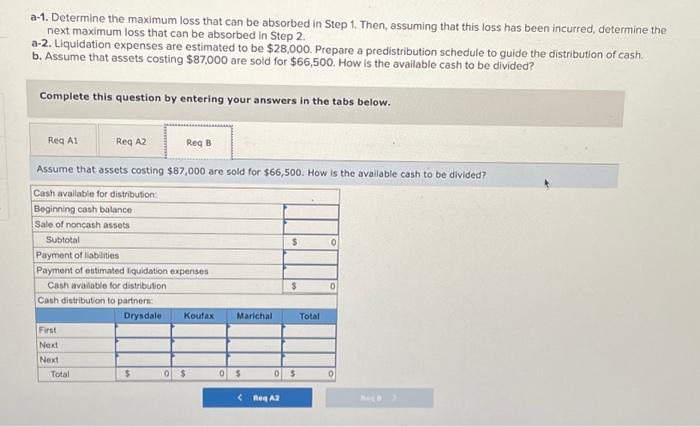

equired: a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Uquidation expenses are estimated to be \\( \\$ 28,000 \\). Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing \\( \\$ 87,000 \\) are sold for \\( \\$ 66,500 \\). How is the available cash to be divided? Complete this question by entering your answers in the tabs below. Uquidation expenses are estimated to be \\( \\$ 28,000 \\). Prepare a predistribution schedule to guide the distribution of cash. The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Required: a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be \\( \\$ 28,000 \\). Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing \\( \\$ 87,000 \\) are sold for \\( \\$ 66,500 \\). How is the available cash to be divided? a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be \\( \\$ 28,000 \\). Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing \\( \\$ 87,000 \\) are sold for \\( \\$ 66,500 \\). How is the avaliable cash to be divided? Complete this question by entering your answers in the tabs below. Assume that assets costing \\( \\$ 87,000 \\) are sold for \\( \\$ 66,500 \\). How is the available cash to be divided? a-1. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine next maximum loss that can be absorbed in Step 2. a-2. Liquidation expenses are estimated to be \\( \\$ 28,000 \\). Prepare a predistribution schedule to guide the distribution of cash. b. Assume that assets costing \\( \\$ 87,000 \\) are sold for \\( \\$ 66,500 \\). How is the available cash to be divided? Complete this question by entering your answers in the tabs below. Determine the maximum loss that can be absorbed in Step 1. Then, assuming that this loss has been incurred, determine the next maximum loss that can be absorbed in Step 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts