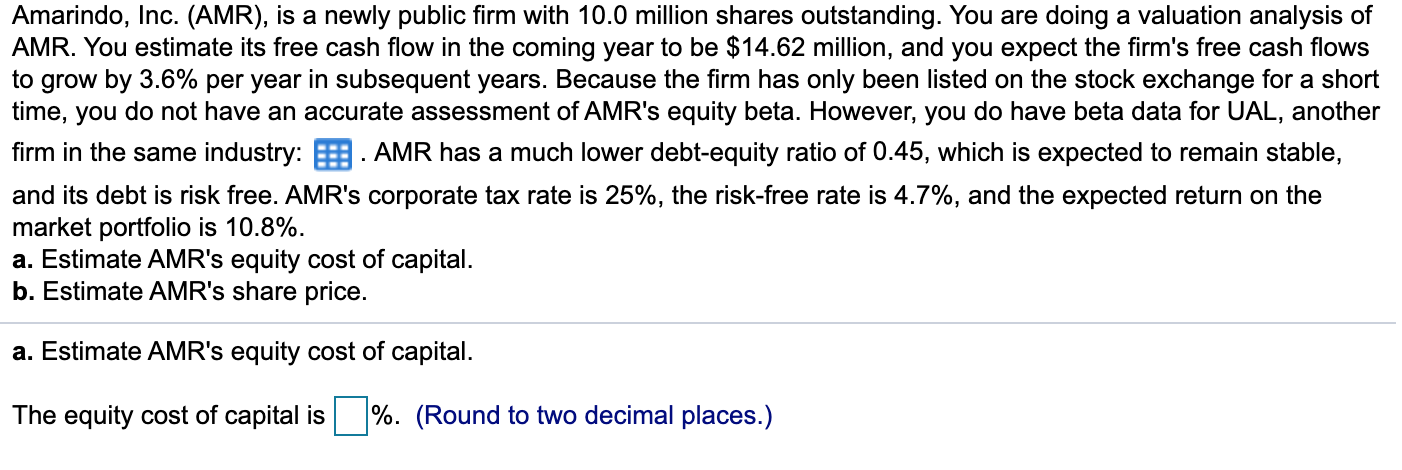

Question: Equity Beta Debt Beta Debt-Equity Ratio UAL 2.25 Equity Beta Debt Beta Debt-Equity Ratio UAL 2.25 0.45 1.5 Amarindo, Inc. (AMR), is a newly public

Equity Beta Debt Beta Debt-Equity Ratio UAL 2.25  Equity Beta Debt Beta Debt-Equity Ratio UAL 2.25 0.45 1.5

Equity Beta Debt Beta Debt-Equity Ratio UAL 2.25 0.45 1.5

Amarindo, Inc. (AMR), is a newly public firm with 10.0 million shares outstanding. You are doing a valuation analysis of AMR. You estimate its free cash flow in the coming year to be $14.62 million, and you expect the firm's free cash flows to grow by 3.6% per year in subsequent years. Because the firm has only been listed on the stock exchange for a short time, you do not have an accurate assessment of AMR's equity beta. However, you do have beta data for UAL, another firm in the same industry: E. AMR has a much lower debt-equity ratio of 0.45, which is expected to remain stable, and its debt is risk free. AMR's corporate tax rate is 25%, the risk-free rate is 4.7%, and the expected return on the market portfolio is 10.8%. a. Estimate AMR's equity cost of capital. b. Estimate AMR's share price. a. Estimate AMR's equity cost of capital. The equity cost of capital is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts