Question: Equity beta is: 6.6 Debt beta is: .2 QUESTION 6 3 pol [Q6-13] You are trying to estimate the enterprise value of Firm X. Since

![pol [Q6-13] You are trying to estimate the enterprise value of Firm](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7882311ef6_27466f7882282855.jpg)

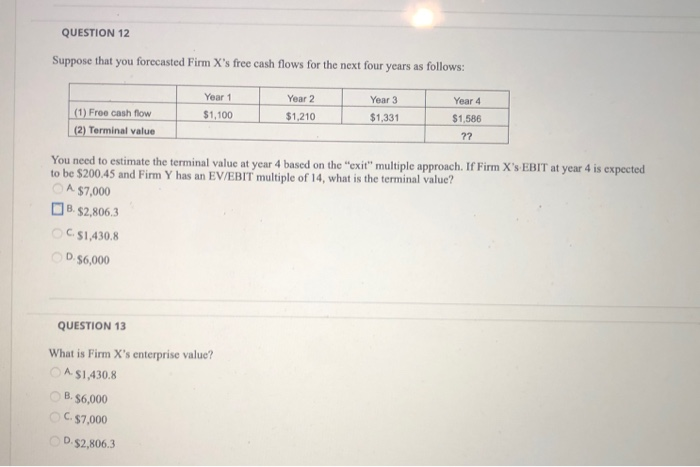

QUESTION 6 3 pol [Q6-13] You are trying to estimate the enterprise value of Firm X. Since this firm is private, you cannot directly estimate the firm's cost of equity using its stock data. Fortunately, there is a similar firm, Firm Y, which is in the same industry with comparable operating risk characteristics. Assume that the CAPM holds. The risk-free rate is 2% and the market risk premium is 5%. QUESTION 10 What is Firm X's cost of equity? A. 15% B. 45% 10% 0.35% QUESTION 11 If the corporate tax rate is 50%, what is Firm X's WACC? A 10% B. 45% C.35% D. 15% QUESTION 12 Suppose that you forecasted Firm X's free cash flows for the next four years as follows: Year 3 Year 4 Year 1 $1,100 Year 2 $1,210 $1,331 $1,586 (1) Free cash flow (2) Terminal value You need to estimate the terminal value at year 4 based on the "exit" multiple approach. If Firm X's EBIT at year 4 is expected to be $200.45 and Firm Y has an EV/EBIT multiple of 14, what is the terminal value? A $7,000 B. $2,806,3 C$1,430,8 D. $6,000 QUESTION 13 What is Firm X's enterprise value? A $1,430.8 B. $6,000 C$7,000 D. $2,806,3 [Q6-13] You are trying to estimate the enterprise value of Firm X. Since this firm is private, you cannot directly estimate the firm's cost of equity using its stock data. Fortunately, there is a similar firm, Firm Y, which is in the same industry with comparable operating risk characteristics. Assume that the CAPM holds. The risk-free rate is 2% and the market risk premium is 5%. Firm Y has a debt-to-equity ratio of 3 and it plans to keep this ratio fixed. Firm Y's equity beta is 6.6 and debt beta is 0.2. What is Firm Y's unlevered equity beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts