Question: Equity Method and Ellminating Entries, Second Year On January 1 , 2 0 2 3 , Playtel Inc. acquired all of the stock of San

Equity Method and Ellminating Entries, Second Year

On January Playtel Inc. acquired all of the stock of San Jose Cable for $ million in cash. At the date of acquisitlon, San Jose's shareholders'

equity accounts were as follows in thousands:

Both companies have a December yearend. At the date of acquisition, San Jose's reported net assets had book values approximating fair value.

However, It had previously unreported Indefinitelife dible intangibles valued at $ milllion, meeting ASC Topic requirements for

capitalization. Impairment losses in for Identiflable intangibles were $ Goodwill from this acquisitlon was not impaired in San Jose

reported net income of $ million in and paid no dividends. Playtel uses the complete equity method to report its investment in San Jose on its

own books.

It is now December two years since the acquisition, In San jose reported net income of $ million and declared and paid dividends of

$ Impairment losses on the identiflable intangibles were $ million, and goodwill was impaired by $

Note: Provide all answers in thousands.

a Calculate equity in net income of San Jose for reported on Playtel's books

b Calculate the December Investment balance, reported on Playtel's books.

c Prepare eliminating entries CER and O required to consolidate Playtel's trial balance accounts with those of San Jose on December

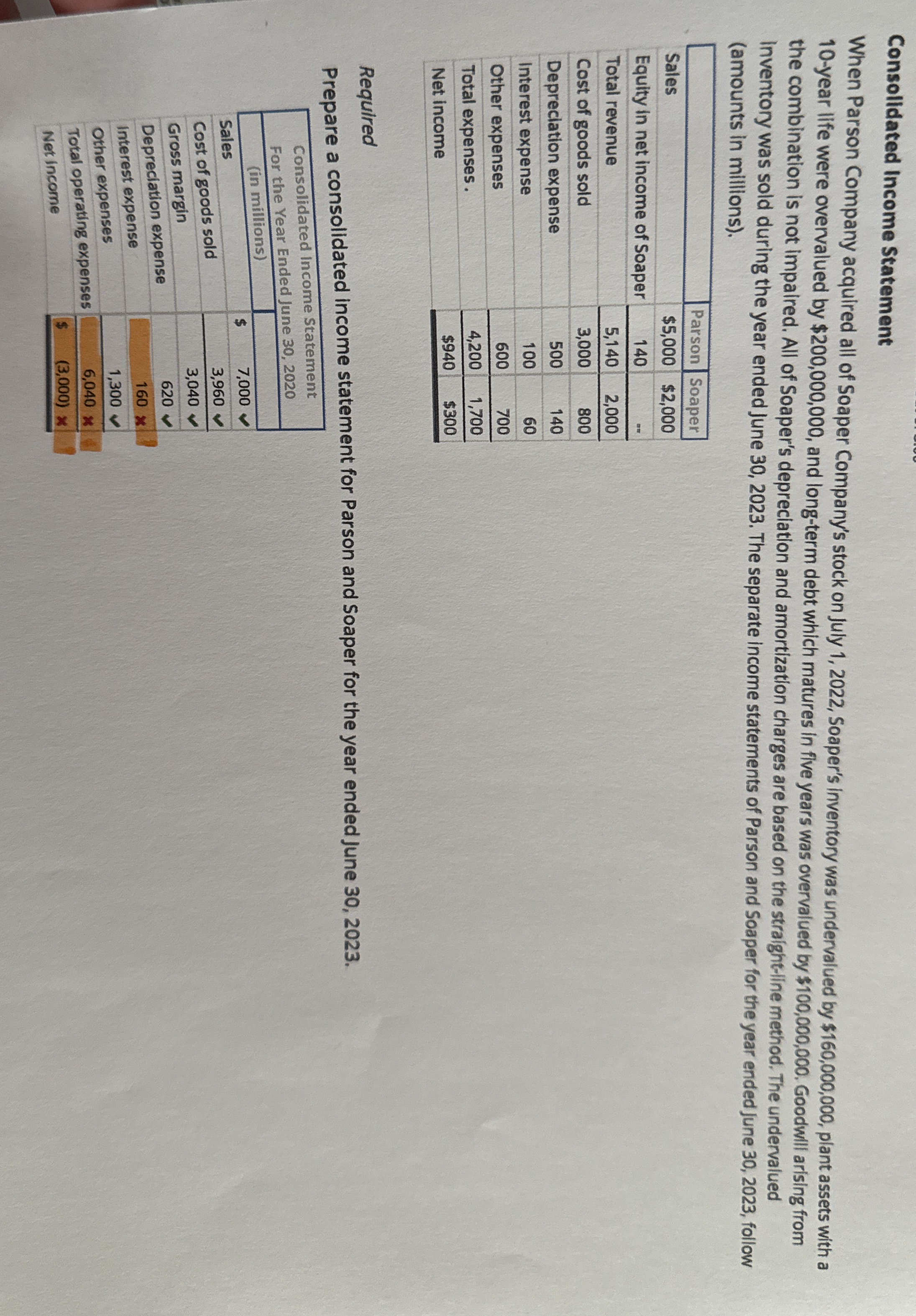

Consolidated Income Statement

When Parson Company acquired all of Soaper Company's stock on July Soaper's inventory was undervalued by $ plant assets with a

year life were overvalued by $ and longterm debt which matures in flve years was overvalued by $ Goodwill arising from

the combination is not impaired. All of Soaper's depreciation and amortization charges are based on the straightline method. The undervalued

inventory was sold during the year ended June The separate income statements of Parson and Soaper for the year ended June follow

amounts in millions

Required

Prepare a consolidated income statement for Parson and Soaper for the year ended June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock