Question: Equity method with noncontrolling interest AAP n upstream intercompant sale ompiee teg entries according to the C-E-A-D-I sequence and complete the consolidation worksheet s%. Consolidation

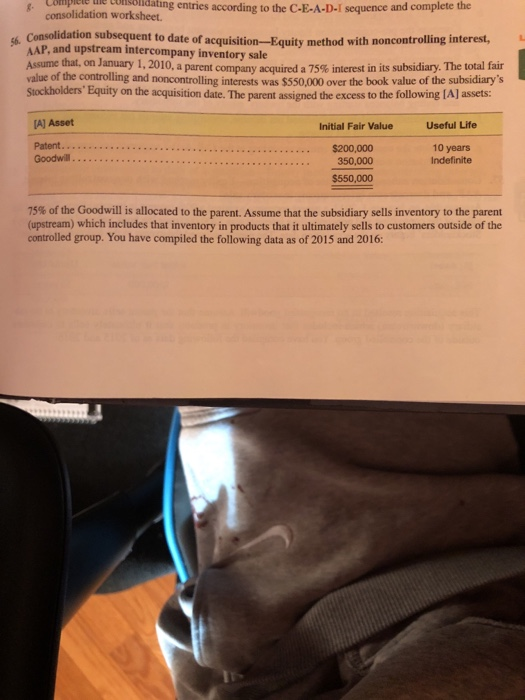

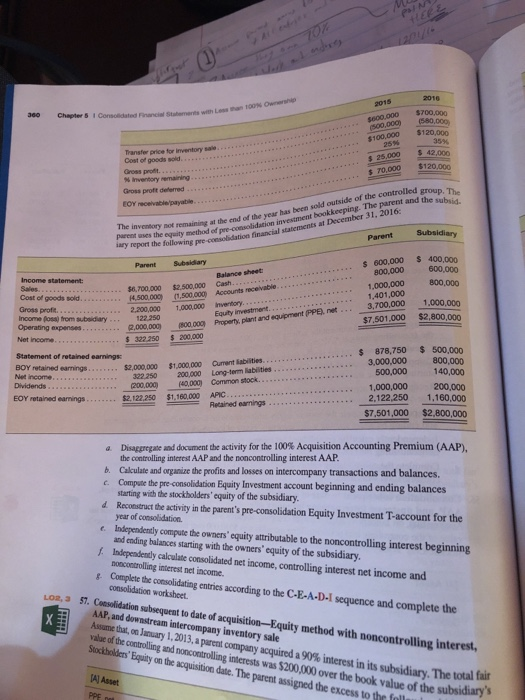

ompiee teg entries according to the C-E-A-D-I sequence and complete the consolidation worksheet s%. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and upstream intercompany inventory sale Assume that, on January 1, 2010, a parent company acquired value of the controlling and noncontrolling interests was $550,000 over the book value of the subsidiary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following IAJ assets: a 75% interest in its subsidiary. The total fair AJ Asset Useful Life Initial Fair Value Patent Goodwill.. $200,000 350,000 10 years Indefinite $550,000 75% of the Goodwill is allocated to the parent. Assume that the subsidiary sells inventory to the parent (upstream) which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data as of 2015 and 2016: ompiee teg entries according to the C-E-A-D-I sequence and complete the consolidation worksheet s%. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and upstream intercompany inventory sale Assume that, on January 1, 2010, a parent company acquired value of the controlling and noncontrolling interests was $550,000 over the book value of the subsidiary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following IAJ assets: a 75% interest in its subsidiary. The total fair AJ Asset Useful Life Initial Fair Value Patent Goodwill.. $200,000 350,000 10 years Indefinite $550,000 75% of the Goodwill is allocated to the parent. Assume that the subsidiary sells inventory to the parent (upstream) which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data as of 2015 and 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts