Question: Equity Problem & Depreciation -- How would you do these two problems? Bruins Inc. has the following items in their current balance sheet: Common Stock

Equity Problem & Depreciation -- How would you do these two problems?

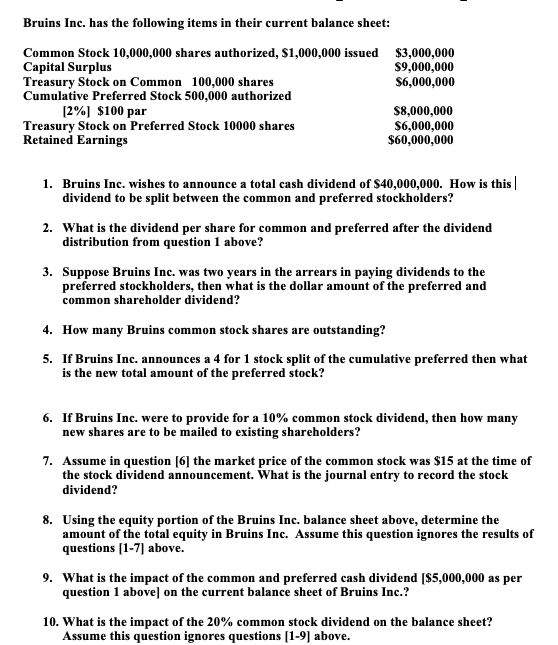

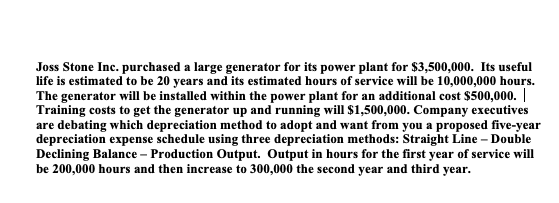

Bruins Inc. has the following items in their current balance sheet: Common Stock 10,000,000 shares authorized, S1,000,000 issued Capital Surplus Treasury Stock on Common 100,000 shares Cumulative Preferred Stock 500,000 authorized $3,000,000 S9,000,000 S6,000.000 12%) $100 par $8,000,000 S6,000,000 $60.000.000 Treasury Stock on Preferred Stock 10000 shares Retained Earnings Bruins Inc. wishes to announce a total cash dividend of S40,000,000. How is this l dividend to be split between the common and preferred stockholders? 1. 2. What is the dividend per share for common and preferred after the dividend distribution from question 1 above? 3. Suppose Bruins Inc. was two years in the arrears in paying dividends to the preferred stockholders, then what is the dollar amount of the preferred and common shareholder dividend? 4. How many Bruins common stock shares are outstanding? 5. If Bruins Inc. announces a 4 for 1 stock split of the cumulative preferred then what is the new total amount of the preferred stock? 6. If Bruins Inc. were to provide for a 10% common stock dividend, then how many new shares are to be mailed to existing shareholders? 7. Assume in question [6] the market price of the common stock was $15 at the time of the stock dividend announcement. What is the journal entry to record the stock dividend? 8. Using the equity portion of the Bruins Inc. balance sheet above, determine the amount of the total equity in Bruins Inc. Assume this question ignores the results of questions 1-7] above. 9. What is the impact of the common and preferred cash dividend [$5,000,000 as per question 1 abovel on the current balance sheet of Bruins Inc.? 10. What is the impact of the 20% common stock dividend on the balance sheet? Assume this question ignores questions [1-9] above. its power service will be 1 Joss Stone Inc. purchased a large generator for its power plant for $3,500,000. Its useful life is estimated to be 20 years and its estimated hours of service will be 10,000,000 hours. The generator will be installed within the power plant for an additional cost $500,000. Training costs to get the generator up and running will $1,500,000. Company executives are debating which depreciation method to adopt and want from you a proposed five-year depreciation expense schedule using three depreciation methods: Straight Line - Double Declining Balance - Production Output. Output in hours for the first year of service will be 200,000 hours and then increase to 300,000 the second year and third year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts