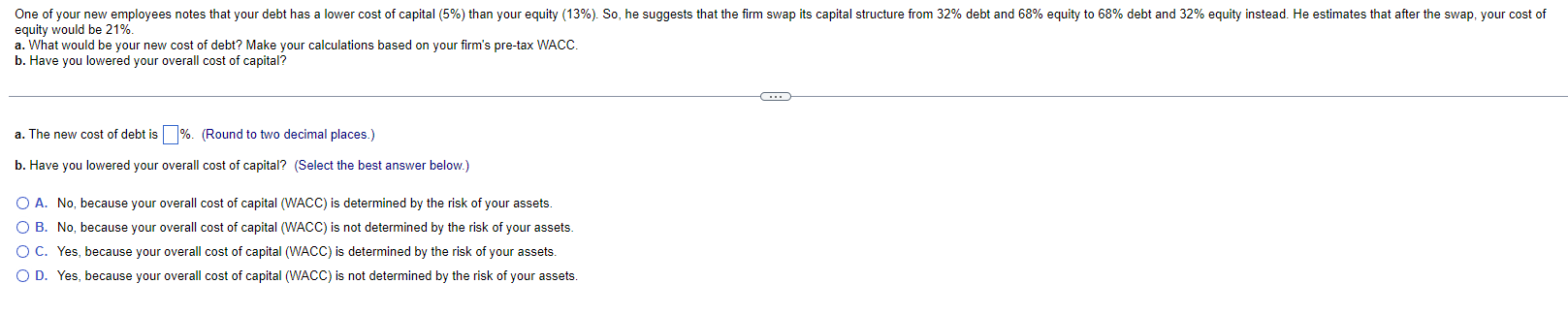

Question: equity would be 21%. a. What would be your new cost of debt? Make your calculations based on your firm's pre-tax WACC. b. Have you

equity would be 21%. a. What would be your new cost of debt? Make your calculations based on your firm's pre-tax WACC. b. Have you lowered your overall cost of capital? a. The new cost of debt is %. (Round to two decimal places.) b. Have you lowered your overall cost of capital? (Select the best answer below.) A. No, because your overall cost of capital (WACC) is determined by the risk of your assets. B. No, because your overall cost of capital (WACC) is not determined by the risk of your assets. C. Yes, because your overall cost of capital (WACC) is determined by the risk of your assets. D. Yes, because your overall cost of capital (WACC) is not determined by the risk of your assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts