Question: Equivalent Units and Product Cost Report - Weighted Average Method In it's first month's operations, Allred Company's Department 1 incurred charges of $ 1 8

Equivalent Units and Product Cost ReportWeighted Average Method

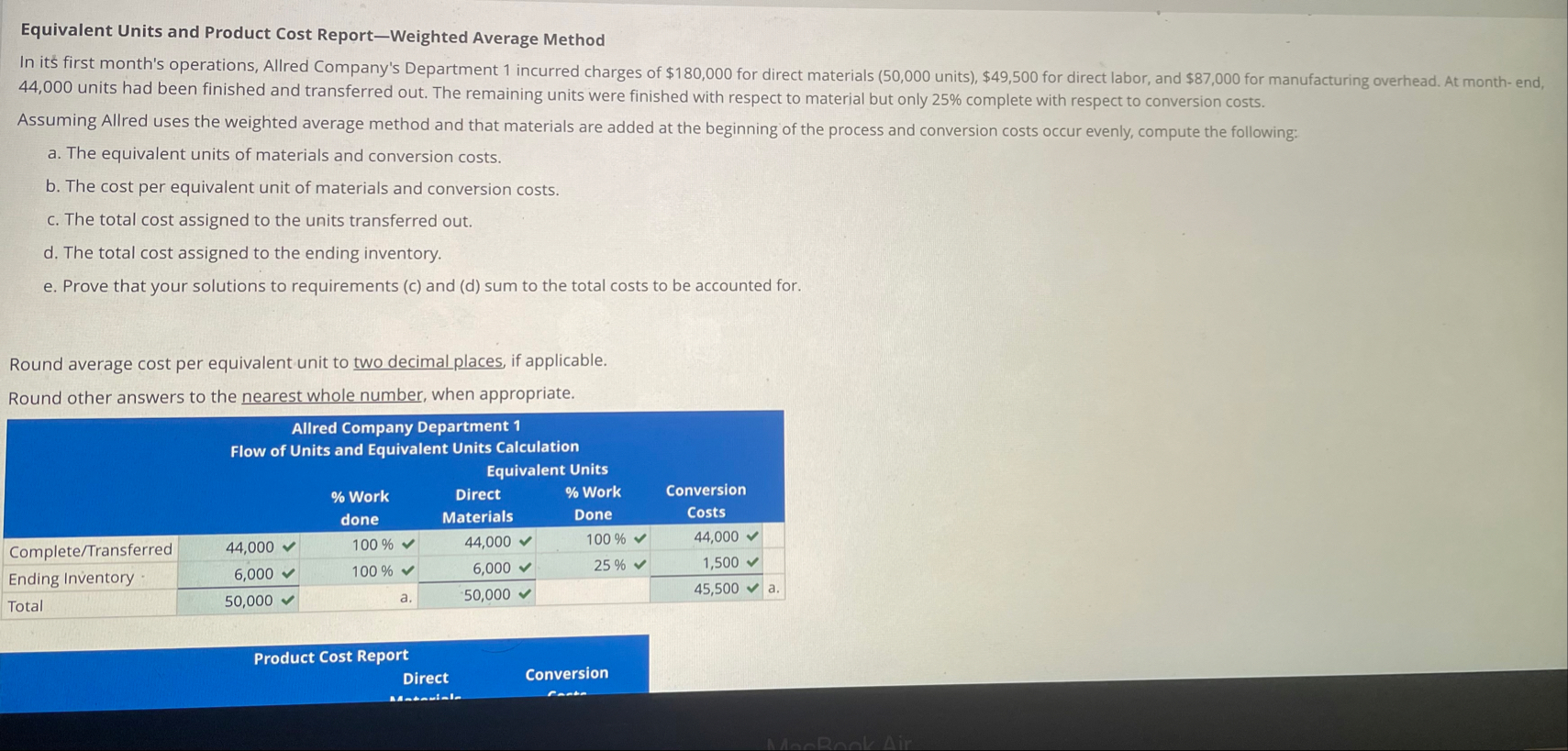

In it's first month's operations, Allred Company's Department incurred charges of $ for direct materials units $ for direct labor, and $ for manufacturing overhead. At month end, units had been finished and transferred out. The remaining units were finished with respect to material but only complete with respect to conversion costs.

Assuming Allred uses the weighted average method and that materials are added at the beginning of the process and conversion costs occur evenly, compute the following:

a The equivalent units of materials and conversion costs.

b The cost per equivalent unit of materials and conversion costs.

c The total cost assigned to the units transferred out.

d The total cost assigned to the ending inventory.

e Prove that your solutions to requirements c and d sum to the total costs to be accounted for.

Round average cost per equivalent unit to two decimal places, if applicable.

Round other answers to the nearest whole number, when appropriate.

tabletableAllred Company Department Flow of Units and Equivalent Units CalculationEquivalent Units Work done,,Direct Materials, Work Done,Conversion Costs,CompleteTransferredEnding Inventory,Totalaa

Product Cost Report

Direct

Conversion

Round average cost per equivalent unit to two decimal places, if applicable.

Round other answers to the nearest whole number, when appropriate.

tableAllred Company Department Flow of Units and Equivalent Units Calculation Equivalent Units Work done,Direct Materials, Work Done,Conversion Costs,CompleteTransferredEnding Inventory,Totalaa

tabletableProduct Cost ReportDirect MaterialsConversion CostsBeginning Inventory,$$$CurrentxTotal Costs to Account For,$$$ Total Equivalent Units,,Average cost Equivalent unit,,$b$b

tableComplete Transferred:,,Direct Materials,$Conversion costs,,Cost of Goods Manufactured,$

Ending Inventory:

tableDirect Materials,$Conversion costs,

Can you Correct all the parts I got wrong. They have an red X jn the blue and summarize it for me so that I can easily identify where each number goes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock