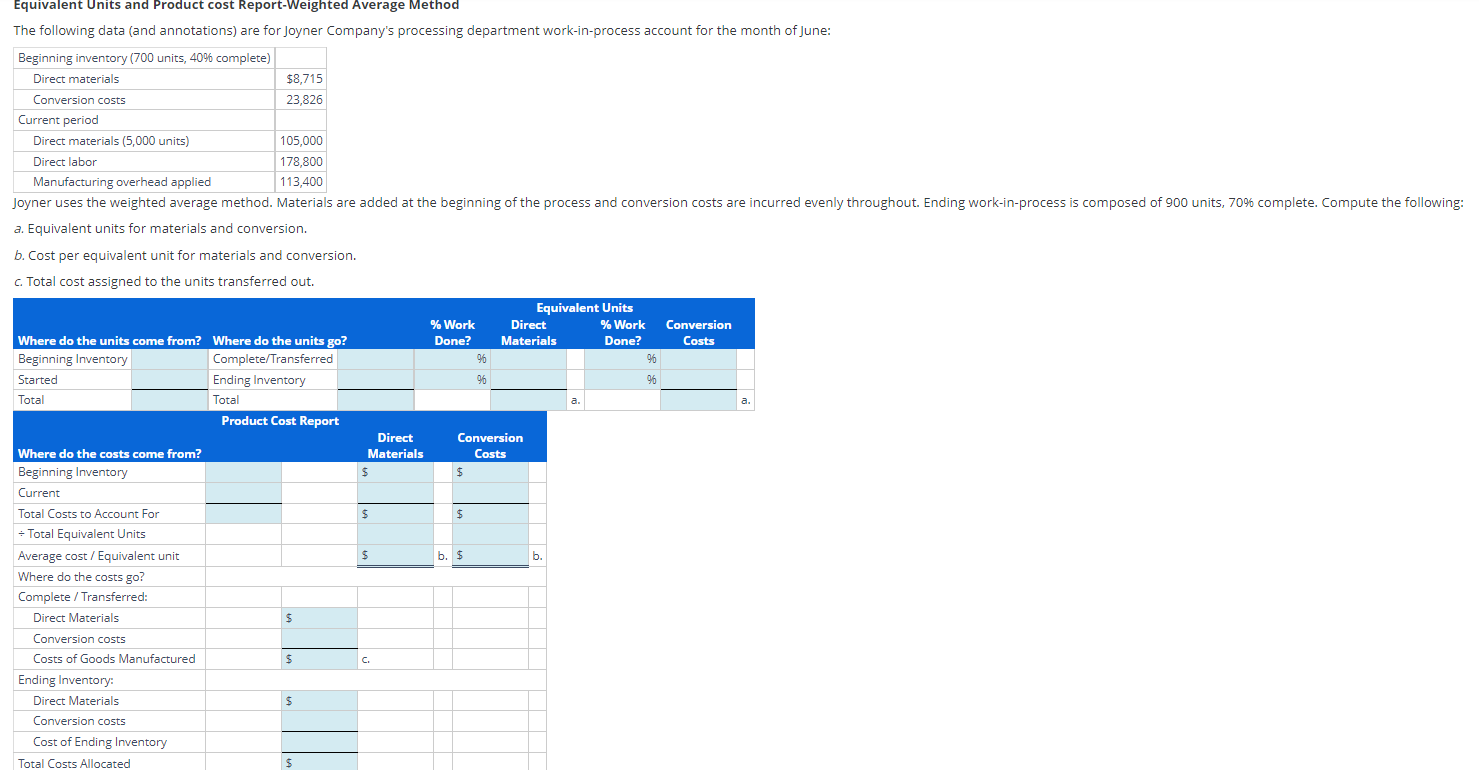

Question: Equivalent Units and Product cost Report-Weighted Average Method The following data (and annotations) are for Joyner Company's processing department work-in-process account for the month

Equivalent Units and Product cost Report-Weighted Average Method The following data (and annotations) are for Joyner Company's processing department work-in-process account for the month of June: Beginning inventory (700 units, 40% complete) Direct materials Conversion costs Current period Direct materials (5,000 units) Direct labor Manufacturing overhead applied $8,715 23,826 105,000 178,800 113,400 Joyner uses the weighted average method. Materials are added at the beginning of the process and conversion costs are incurred evenly throughout. Ending work-in-process is composed of 900 units, 70% complete. Compute the following: a. Equivalent units for materials and conversion. b. Cost per equivalent unit for materials and conversion. c. Total cost assigned to the units transferred out. Where do the units come from? Where do the units go? Beginning Inventory Started Total Complete/Transferred Ending Inventory Total Where do the costs come from? Beginning Inventory Current Total Costs to Account For Total Equivalent Units Average cost/Equivalent unit Where do the costs go? Equivalent Units % Work Done? Direct Materials % Work Done? Conversion Costs 96 %6 % Product Cost Report Direct Conversion Materials Costs $ $ $ $ $ b. $ b. Complete / Transferred: Direct Materials $ Conversion costs Costs of Goods Manufactured $ C. Ending Inventory: Direct Materials $ Conversion costs Cost of Ending Inventory Total Costs Allocated $

Step by Step Solution

There are 3 Steps involved in it

Joyner Company Work in Process June a Equivalent Units Direct Materials Since materials are added at the beginning of the process all units are considered 100 complete for materials Equivalent Units f... View full answer

Get step-by-step solutions from verified subject matter experts