Question: er 4 i Saved Help Save & Exit Submit Check my work Problem 04-01 (Static) [LO 4-2] Using the 2021 corporate tax rate: Required: a.

![work Problem 04-01 (Static) [LO 4-2] Using the 2021 corporate tax rate:](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7b9da1c11f_00166f7b9d983803.jpg)

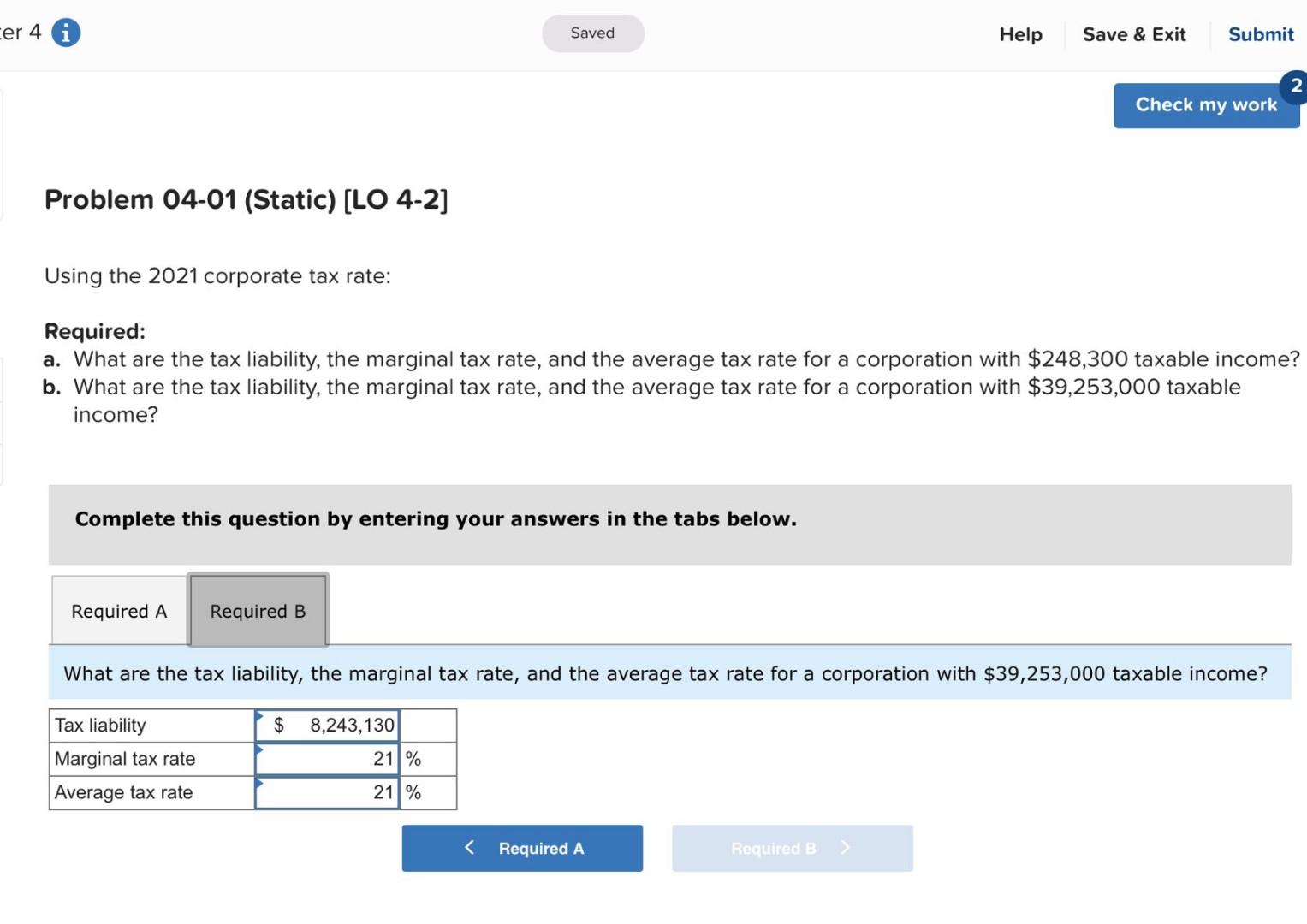

er 4 i Saved Help Save & Exit Submit Check my work Problem 04-01 (Static) [LO 4-2] Using the 2021 corporate tax rate: Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $248,300 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $39,253,000 taxable income? Complete this question by entering your answers in the tabs below. Required A Required B What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $39,253,000 taxable income? Tax liability $ 8,243,130 Marginal tax rate 21% Average tax rate 21% er 4 i Saved Help Save & Exit Submit Check my work Problem 04-01 (Static) [LO 4-2] Using the 2021 corporate tax rate: Required: a. What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $248,300 taxable income? b. What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $39,253,000 taxable income? Complete this question by entering your answers in the tabs below. Required A Required B What are the tax liability, the marginal tax rate, and the average tax rate for a corporation with $39,253,000 taxable income? Tax liability $ 8,243,130 Marginal tax rate 21% Average tax rate 21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts