Question: ERGENT: Assume that JC Penney's will experience a $1.5 billion net income loss for 2014 and that the cash balance of $1 billion is required

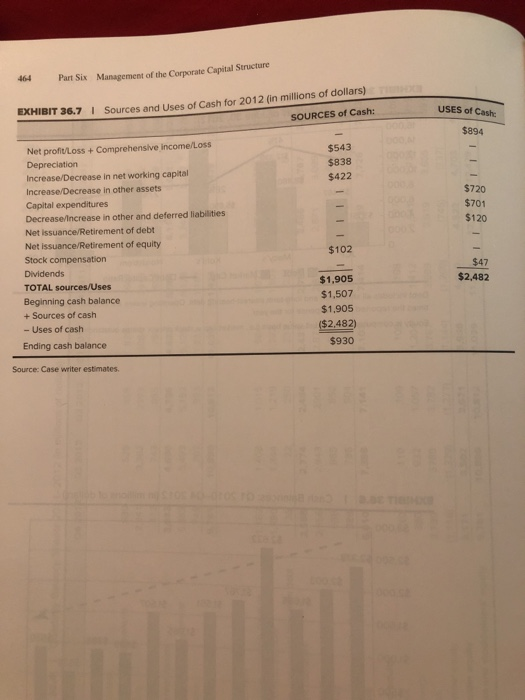

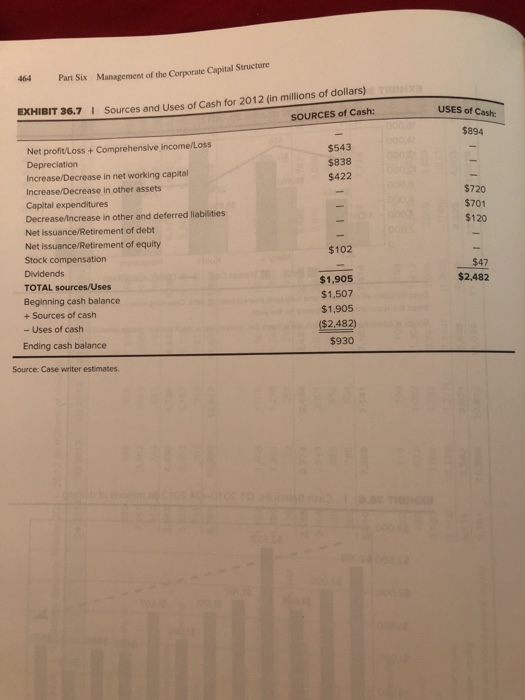

464 Part Six Management of the Corporate Capital Structure Sources and Uses of Cash for 2012 in millions of dollars) EXHIBIT 36.7 SOURCES of Cash: USES of Cash $894 $543 $838 $422 $720 $701 $120 Net profit Loss + Comprehensive income/Loss Depreciation Increase/Decrease in net working capital Increase/Decrease in other assets Capital expenditures Decrease/Increase in other and deferred liabilities Net issuance/Retirement of debt Net issuance/Retirement of equity Stock compensation Dividends TOTAL sources/Uses Beginning cash balance + Sources of cash - Uses of cash Ending cash balance $102 $47 $2,482 $1,905 $1.507 $1.905 ($2.482) $930 Source: Case writer estimates. 464 Part Six Management of the Corporate Capital Structure Sources and Uses of Cash for 2012 in millions of dollars) EXHIBIT 36.7 SOURCES of Cash: USES of Cash $894 $543 $838 $422 $720 $701 $120 Net profit Loss + Comprehensive income/Loss Depreciation Increase/Decrease in net working capital Increase/Decrease in other assets Capital expenditures Decrease/Increase in other and deferred liabilities Net issuance/Retirement of debt Net issuance/Retirement of equity Stock compensation Dividends TOTAL sources/Uses Beginning cash balance + Sources of cash - Uses of cash Ending cash balance $102 $47 $2,482 $1,905 $1,507 $1.905 ($2.482) $930 Source: Case writer estimates. 464 Part Six Management of the Corporate Capital Structure Sources and Uses of Cash for 2012 in millions of dollars) EXHIBIT 36.7 SOURCES of Cash: USES of Cash $894 $543 $838 $422 $720 $701 $120 Net profit Loss + Comprehensive income/Loss Depreciation Increase/Decrease in net working capital Increase/Decrease in other assets Capital expenditures Decrease/Increase in other and deferred liabilities Net issuance/Retirement of debt Net issuance/Retirement of equity Stock compensation Dividends TOTAL sources/Uses Beginning cash balance + Sources of cash - Uses of cash Ending cash balance $102 $47 $2,482 $1,905 $1.507 $1.905 ($2.482) $930 Source: Case writer estimates. 464 Part Six Management of the Corporate Capital Structure Sources and Uses of Cash for 2012 in millions of dollars) EXHIBIT 36.7 SOURCES of Cash: USES of Cash $894 $543 $838 $422 $720 $701 $120 Net profit Loss + Comprehensive income/Loss Depreciation Increase/Decrease in net working capital Increase/Decrease in other assets Capital expenditures Decrease/Increase in other and deferred liabilities Net issuance/Retirement of debt Net issuance/Retirement of equity Stock compensation Dividends TOTAL sources/Uses Beginning cash balance + Sources of cash - Uses of cash Ending cash balance $102 $47 $2,482 $1,905 $1,507 $1.905 ($2.482) $930 Source: Case writer estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts