Question: Eric Clapton's 2 2 - year - old daughter Layla has just accepted a job with American Manganese Inc. ( AMYZF ) , an up

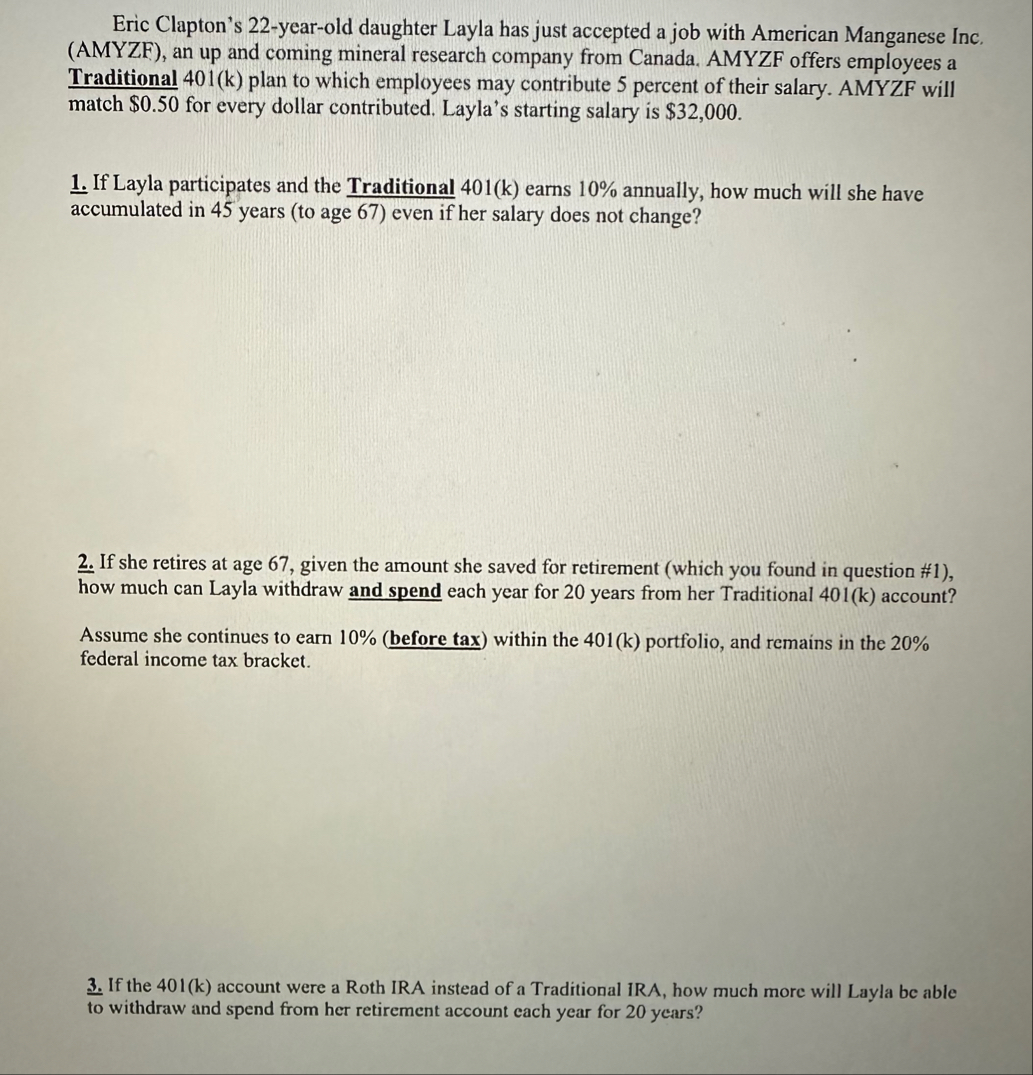

Eric Clapton's yearold daughter Layla has just accepted a job with American Manganese Inc. AMYZF an up and coming mineral research company from Canada. AMYZF offers employees a Traditional plan to which employees may contribute percent of their salary. AMYZF will match $ for every dollar contributed. Layla's starting salary is $

If Layla participates and the Traditional earns annually, how much will she have accumulated in years to age even if her salary does not change?

If she retires at age given the amount she saved for retirement which you found in question # how much can Layla withdraw and spend each year for years from her Traditional k account?

Assume she continues to earn before tax within the portfolio, and remains in the federal income tax bracket.

If the account were a Roth IRA instead of a Traditional IRA, how much more will Layla be able to withdraw and spend from her retirement account each year for years?

In Q you first need to find the payment based on the matching plan, this is your PMT that you contribute each year to the k account. There is no stated starting balance so PV would be zero, and it is all annual data so nothing to adjust with the inputs. Because this is a tax protected IRA account, the annual earnings will remain at the taxes will only be applied once there are distributions from the Traditional IRA account. You should get a little above $ million in total savings after years of working.

In Q you are looking at draining the account during retirement, so your FV from Q becomes your PV for Q The IY value stays at because whatever $ amount you do nt take out during your first year of retirement, stays in the tax protected IRA account, continuing to earn you tax free income. FV should be zero because once you make your last withdrawal the account is empty. You should first get a value a little above $ however, this is a Traditional IRA so you have to pay taxes on your distribution each year, so multiply your PMT value by Tax Rate to find your after tax value, it should be just above $

For Q the savings, Q FV would be the same from Q it does not matter if you choose a Roth or Traditional IRA account, they are both tax protected while you contribute and the employer offers the same matching plan regardless of if you chose a Roth or Traditional. So the first steps would be the same as the Traditional in Qs and but then the distribution is not taxed. So the answer here should be the taxes from Q since the full $ approximate value that was a middle step back in Q is not taxed here. The take away here is that you save a significantly larger amount during retirement in the Roth account, and only give up a little bit of tax savings each year while working if you chose the Traditional account. Remember, k and IRA are no different tax wise, IRA is just managed by the person while a k is run through the employer and a financial firm.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock