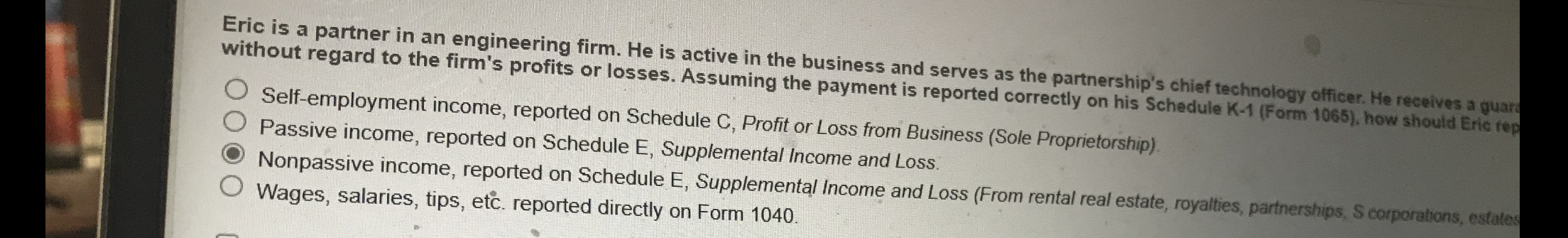

Question: Eric is a partner in an engineering firm. He is active in the business and serves as the partnership's chief technology officer. He receives a

Eric is a partner in an engineering firm. He is active in the business and serves as the partnership's chief technology officer. He receives a guara without regard to the firm's profits or losses. Assuming the payment is reported correctly on his Schedule KForm how should Eric fep

Selfemployment income, reported on Schedule C Profit or Loss from Business Sole Proprietorship

Passive income, reported on Schedule E Supplemental Income and Loss.

Nonpassive income, reported on Schedule E Supplemental Income and Loss From rental real estate, royalties, partnerships, Scorporations, estates

Wages, salaries, tips, etc reported directly on Form

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock