Question: Eric is purchasing a put option to hedge his transaction exposure. It has an underlying asset of MXN 205,773, a strike price of USD 0.050

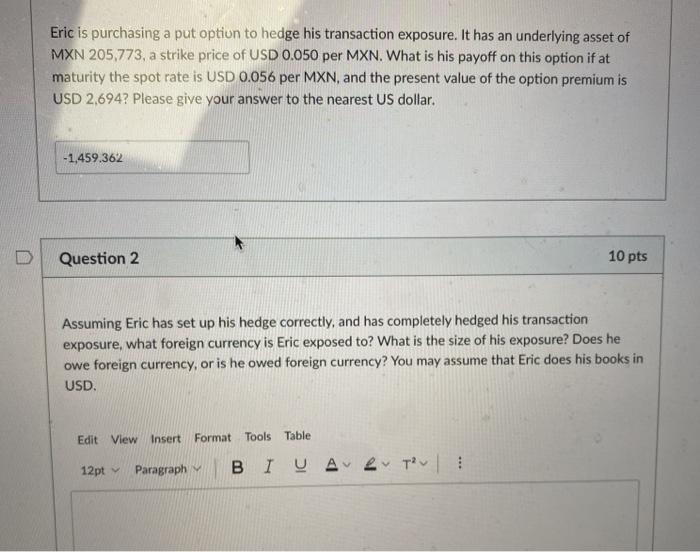

Eric is purchasing a put option to hedge his transaction exposure. It has an underlying asset of MXN 205,773, a strike price of USD 0.050 per MXN. What is his payoff on this option if at maturity the spot rate is USD 0.056 per MXN, and the present value of the option premium is USD 2,694? Please give your answer to the nearest US dollar. -1,459.362 Question 2 10 pts Assuming Eric has set up his hedge correctly, and has completely hedged his transaction exposure, what foreign currency is Eric exposed to? What is the size of his exposure? Does he owe foreign currency, or is he owed foreign currency? You may assume that Eric does his books in USD Edit View Insert Format Tools Table 12pt Paragraph BIU A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts