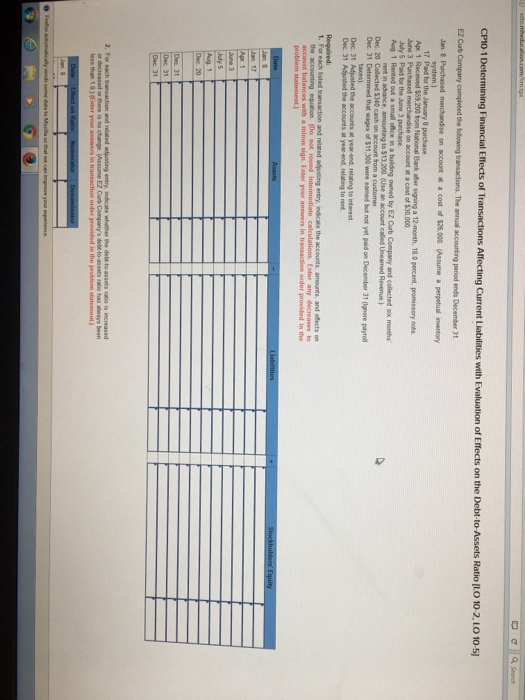

Question: ermining Financial Effects of Transactions Affecting Current Liabilities with Evaluation of Effects on the Debt-to-Assets Ratio LO 10 2, LO 10-51 EZ Cub Cempany completed

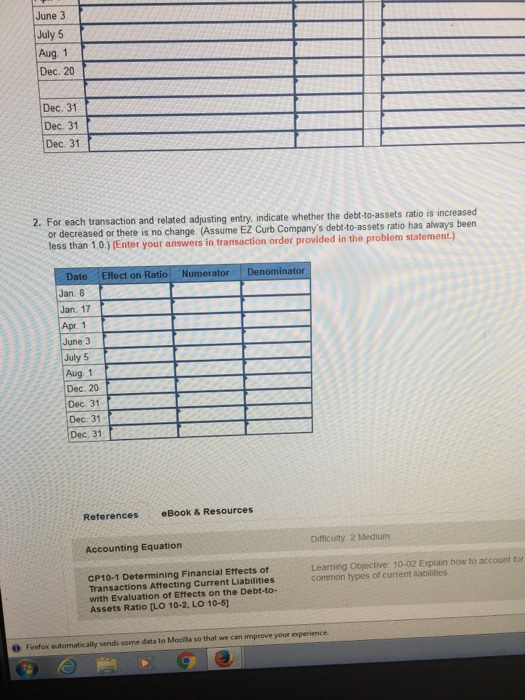

ermining Financial Effects of Transactions Affecting Current Liabilities with Evaluation of Effects on the Debt-to-Assets Ratio LO 10 2, LO 10-51 EZ Cub Cempany completed the tollowing transactions. The annual accourting period ends December 31 Jan. 8 Purchased merchandise on account at a cost of 526,000 (Assume a perpetual inventory 17 Paid for the January 8 purchase June 3 July 5 Paid for the June3 Aug 1 Rented out a small office in a building owned by EZ Curb Company and collected six months Dec. 20 Dec 31 358.200 tom Nuational Bark ater signing a 12-month, 18.0 percent, promssory note eonaccount ar acost of 530 000 to $13,.200. (Use an account called Uneamed Revenue. that wages of $11,300 were earmed but not yet paid on December 31 Ognore payroll Dec. 31 Adyated the accounts at year end, relating to interest Dec. 31 Adiusted the accounts at year end, relating to rent Requieed: 1. For each listed transaction and relared adusting entry, indicate the accounts, amounts, and effects on the accounting problem statement) Dec. 31 2. For each bransaction and related adjusting entry, indicate whether the debt to assets ratio is aleays been

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts