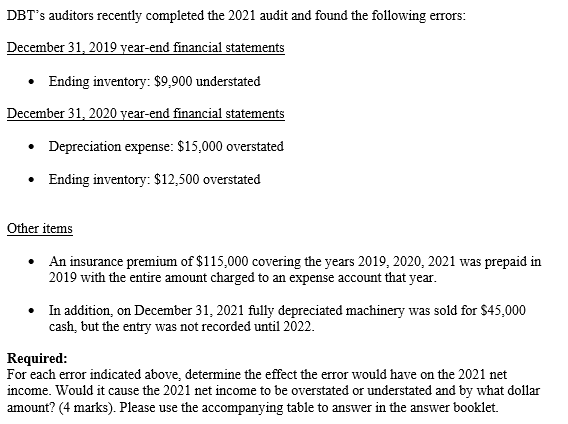

Question: errors: DBT's auditors recently completed the 2021 audit and found the following erro December 31, 2019 year-end financial statements Ending inventory: $9,900 understated December 31,

errors: DBT's auditors recently completed the 2021 audit and found the following erro December 31, 2019 year-end financial statements Ending inventory: $9,900 understated December 31, 2020 year-end financial statements Depreciation expense: $15,000 overstated Ending inventory: $12,500 overstated Other items An insurance premium of $115,000 covering the years 2019, 2020, 2021 was prepaid in 2019 with the entire amount charged to an expense account that year. In addition, on December 31, 2021 fully depreciated machinery was sold for $45,000 cash, but the entry was not recorded until 2022. Required: For each error indicated above, determine the effect the error would have on the 2021 net income. Would it cause the 2021 net income to be overstated or understated and by what dollar amount? (4 marks). Please use the accompanying table to answer in the answer booklet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts