Question: ers 16 & 17 Post-class Assignment i https%253A%252F%25... Saved Help Save & Exit Submit Check my work Investors require an after-tax rate of return of

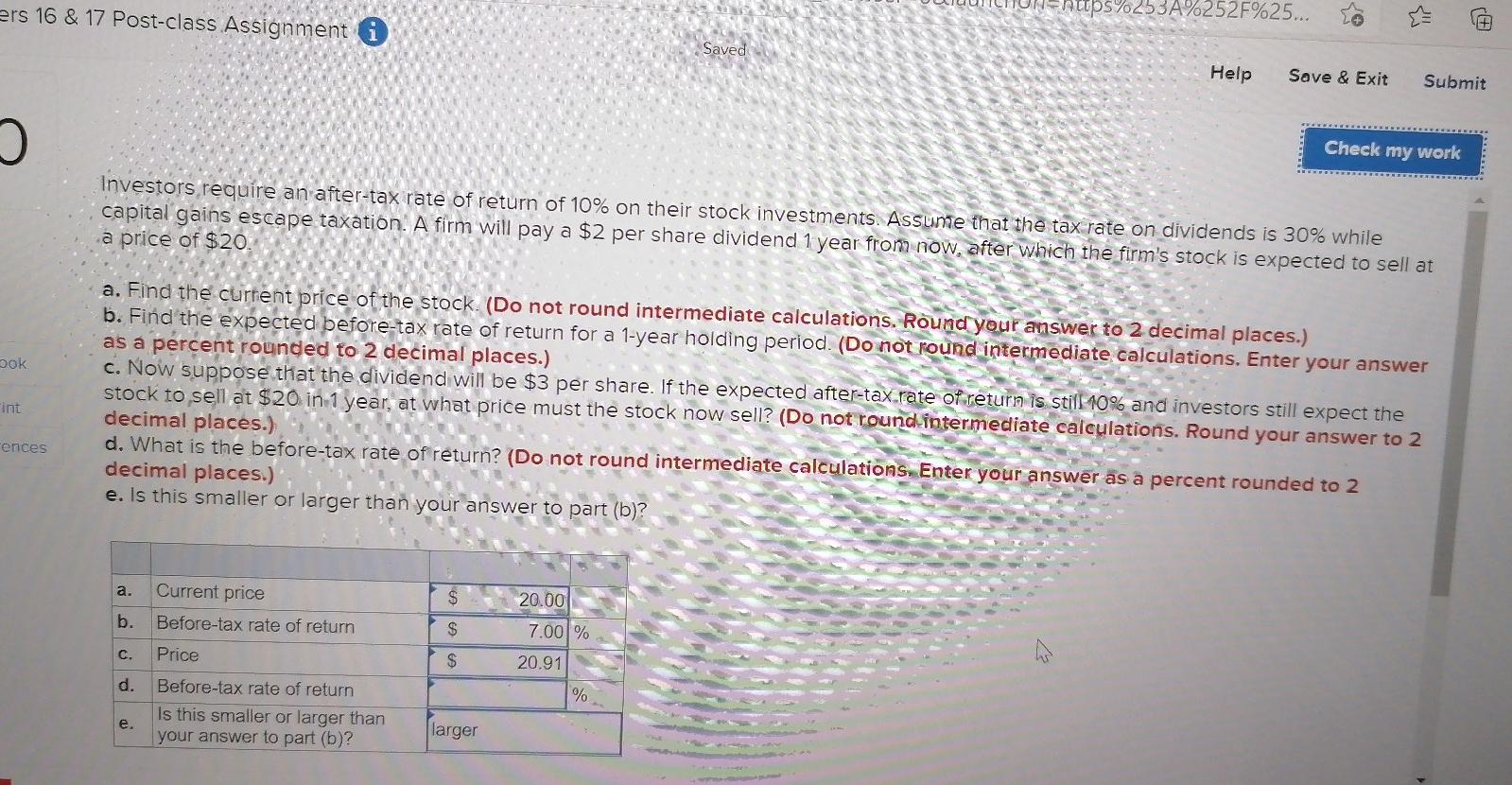

ers 16 & 17 Post-class Assignment i https%253A%252F%25... Saved Help Save & Exit Submit Check my work Investors require an after-tax rate of return of 10% on their stock investments. Assume that the tax rate on dividends is 30% while capital gains escape taxation. A firm will pay a $2 per share dividend 1 year from now, after which the firm's stock is expected to sell at a price of $20 Dok a. Find the current price of the stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Find the expected before-tax rate of return for a 1-year holding period. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Now suppose that the dividend will be $3 per share. If the expected after-tax rate of return is still 10% and investors still expect the stock to sell at $20 in 1 year, at what price must the stock now sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is the before-tax rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. Is this smaller or larger than your answer to part (b)? Fint Fences a. $ 20.00 b. $ Current price Before-tax rate of return Price Before-tax rate of return Is this smaller or larger than your answer to part (b)? 7.00% 20.91 C. $ % e. larger ers 16 & 17 Post-class Assignment i https%253A%252F%25... Saved Help Save & Exit Submit Check my work Investors require an after-tax rate of return of 10% on their stock investments. Assume that the tax rate on dividends is 30% while capital gains escape taxation. A firm will pay a $2 per share dividend 1 year from now, after which the firm's stock is expected to sell at a price of $20 Dok a. Find the current price of the stock. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Find the expected before-tax rate of return for a 1-year holding period. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) c. Now suppose that the dividend will be $3 per share. If the expected after-tax rate of return is still 10% and investors still expect the stock to sell at $20 in 1 year, at what price must the stock now sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. What is the before-tax rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) e. Is this smaller or larger than your answer to part (b)? Fint Fences a. $ 20.00 b. $ Current price Before-tax rate of return Price Before-tax rate of return Is this smaller or larger than your answer to part (b)? 7.00% 20.91 C. $ % e. larger

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts