Question: Erykah asked you to comment on her TSA plan performance. Specifically, she wants to know how well the fund is performing relative to what is

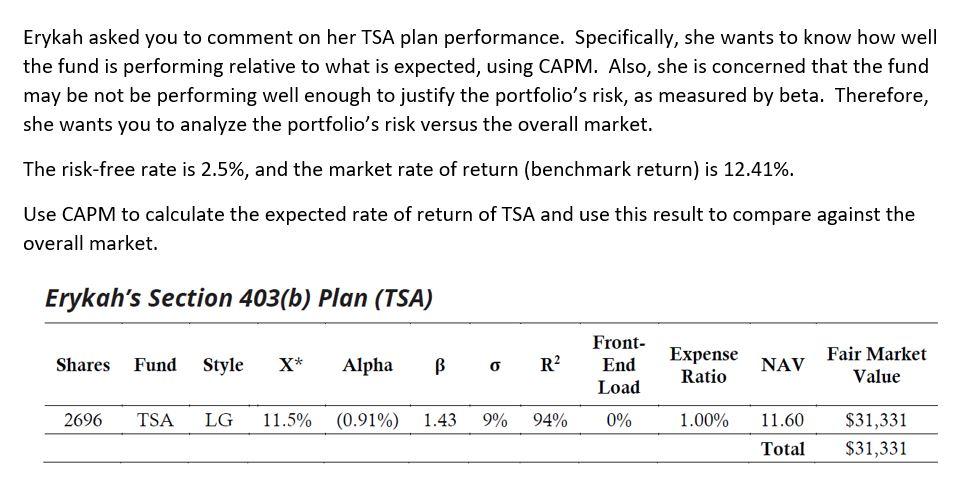

Erykah asked you to comment on her TSA plan performance. Specifically, she wants to know how well the fund is performing relative to what is expected, using CAPM. Also, she is concerned that the fund may be not be performing well enough to justify the portfolio's risk, as measured by beta. Therefore, she wants you to analyze the portfolio's risk versus the overall market. The risk-free rate is 2.5%, and the market rate of return (benchmark return) is 12.41%. Use CAPM to calculate the expected rate of return of TSA and use this result to compare against the overall market. Erykah's Section 403(b) Plan (TSA) Shares Fund Style X* Alpha B o R Front- End Load Expense Ratio NAV Fair Market Value 2696 TSA LG 11.5% (0.91%) 1.43 9% 94% 0% 1.00% 11.60 $31,331 $31,331 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts